Advertisement

LexisNexis Risk Solutions Bolsters Risk Management

LexisNexis Risk Solutions has announced that it has added LexisNexis Behavioral Biometrics to its portfolio of fraud and identity solutions. Behavioral Biometrics combined with existing digital identity intelligence enables organizations to make more reliable fraud and risk decisions.

LexisNexis Behavioral Biometrics is fully integrated into and accessed via LexisNexis ThreatMetrix, an enterprise solution for global digital identity intelligence and authentication powered by insight from billions of transactions, embedded machine learning and a decision platform. It adds an additional layer of defense by analyzing the way a user interacts with a device and reliably differentiates between different user profiles. By layering behavioral biometrics with digital identity intelligence, customers gain additional risk signals across account openings, high-risk pages (log-ins, personal information changes, password resets, payee creation, etc.) and payments.

Behavioral Biometrics enhances an organization's ability to:

►Distinguish between human and bot account activity

►Identify "good" customer profiles

►Reliably profile fraudsters

►Detect session anomalies

►Build confidence relating to returning, trusted customers

►Distinguish between human and bot account activity

►Identify "good" customer profiles

►Reliably profile fraudsters

►Detect session anomalies

►Build confidence relating to returning, trusted customers

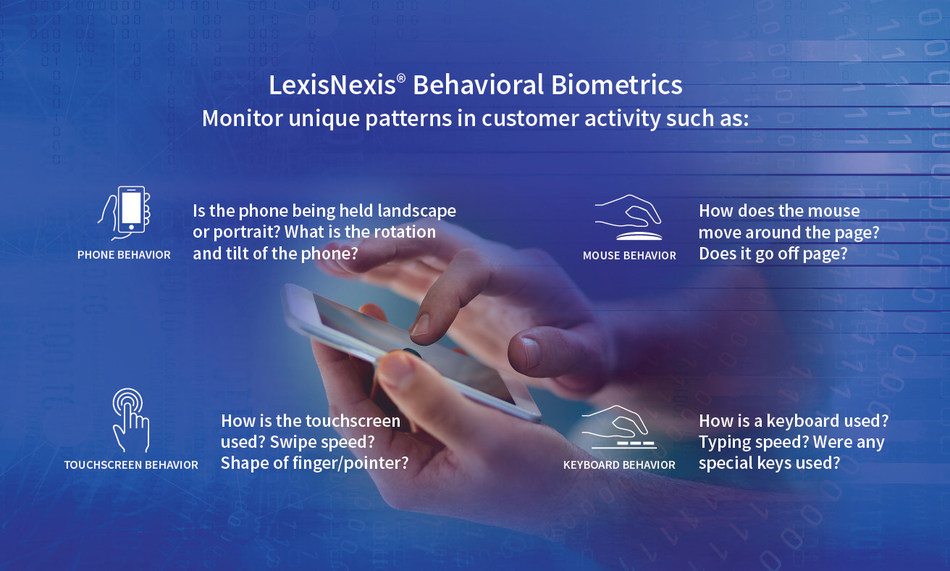

Behavioral biometrics represent a next-generation form of risk assessment based on the way users interact with computers and mobile devices. Algorithms create a unique profile for users by analyzing patterns in their activity, ranging from typing speed and phone tilt to mouse movements and keystroke behavior. Organizations can then use the data to recognize returning users and evaluate risk on any given account.

"Differentiating between good and bad online behavior is harder than ever. Gathering device interaction data across multiple touchpoints in the online journey, however, helps build richer digital profiles," said Kimberly Sutherland, vice president of fraud and identity strategy at LexisNexis Risk Solutions. "As fraudsters continually adapt their strategies to bypass controls, security solutions must be able to distinguish between trustworthy and malicious users in real time, without adding unnecessary friction for good customers.”

Data protection is an essential component of LexisNexis Behavioral Biometrics. The product is "privacy by design" and the system encompasses the strictest data protection measures from the initial stage. The system does not capture password or personally identifiable information, thereby protecting the privacy and security of all identities.

"Cybersecurity needs a holistic approach," said Sutherland. "Unlike point solutions, which often resolve individual vulnerabilities, a layered defense can inform better risk decisions. Where the interplay between behavioral biometrics and digital identity is key, the integration of digital and identity assessment capabilities with behavioral biometrics allows customers to detect high-risk scenarios to allow our customers to better understand the legitimacy of the transacting user. Behavioral biometrics adds an extra passive layer of intelligence to existing fraud and identity solutions, creating a powerful addition in the fight against fraud and cybercrime."

About the author