It’s a new year and your SDG&E electric bill just got more expensive

Electricity rates up an average of 7.8%; gas rates up 24.6%

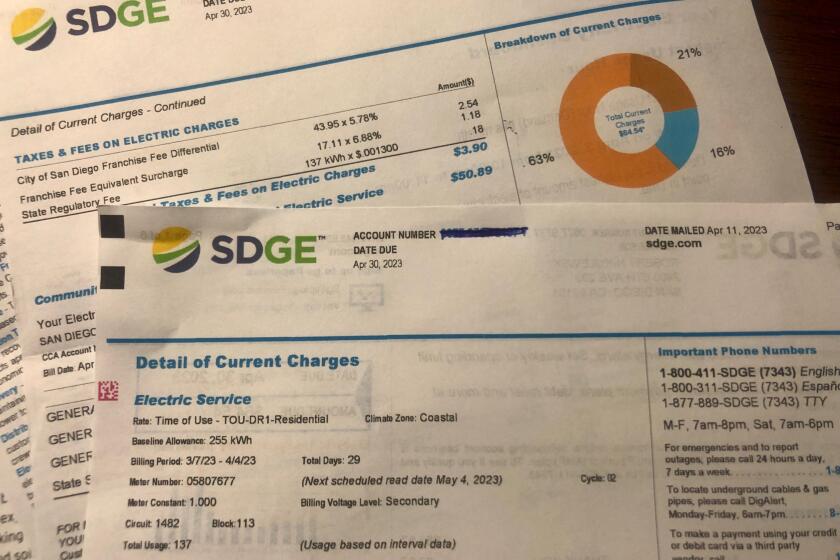

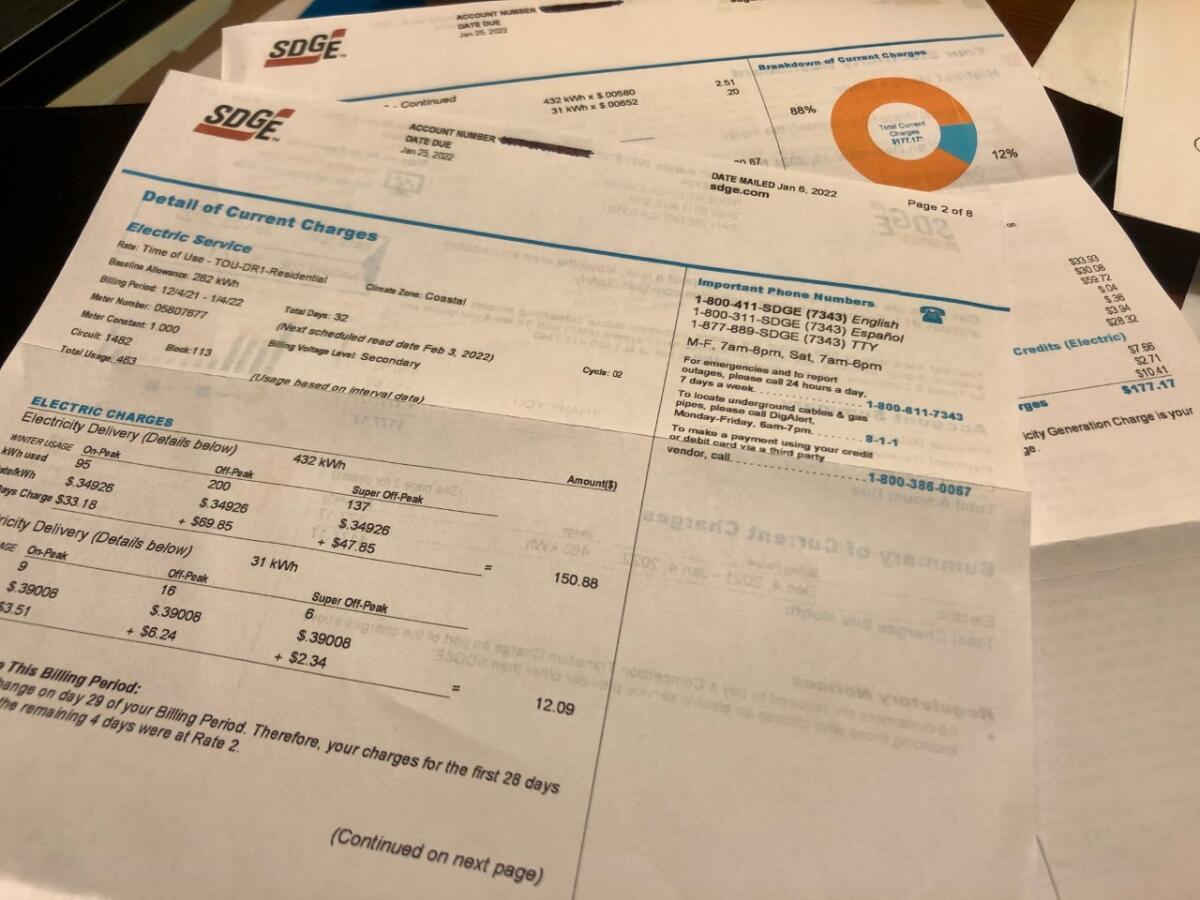

If you’re getting a jolt after looking at your monthly San Diego Gas & Electric bill, you’re not alone.

SDG&E rolled out higher rates in January and many customers have seen their statements jump more than 10 percent compared to one month ago. Utility officials attribute the increases to a host of reasons, including higher natural gas prices seen throughout the country.

This story is for subscribers

We offer subscribers exclusive access to our best journalism.

Thank you for your support.

SDG&E officials say the class average electric rate for residential customers rose 7.8 percent, from 32 cents per kilowatt-hour to 34.5 cents.

The class average includes those enrolled in programs that lower energy bills — such as programs that help lower-income households. That means some electricity customers who aren’t in programs that offer price discounts have seen increases well into the double-digits.

Customers with natural gas hookups have experienced an even steeper rise.

The average cost per therm for an SDG&E residential gas customer has increased 24.6 percent compared to a year ago, from $1.91 per therm to $2.38. And the average bill for a customer using 45 therms of gas has gone up 24.2 percent ($86.11 in January 2021 to $106.98 this year). Of SDG&E’s 3.6 million customers, about 873,000 have gas meters.

Adding to the financial pain: The San Diego area experienced a very cold December, leading customers to turn up the heat in their homes.

The jump in prices has prompted complaints, with some SDG&E customers taking to social media outlets like NextDoor to vent their frustrations.

“There really is no ideal time to increase rates, especially when given the inflationary pressures that are raising the cost of other goods and services,” said Scott Crider, SDG&E’s vice president of Customer Services and External Affairs. “So this makes it more financially difficult for many of our customers.”

Natural gas prices have been on the rise across the country and around the world as demand has outpaced supply.

In October, the futures price for natural gas at Henry Hub, a Louisiana natural gas pipeline that serves as the benchmark for the North American natural gas market on the New York Mercantile Exchange, reached $6 per million British thermal units for the first time in seven years.

Locally, SDG&E’s natural gas is purchased by fellow Sempra subsidiary, Southern California Gas. The price for what’s called “core procurement” that goes to residential and small commercial customers has almost tripled since April 2021 and the price jumped from 65.1 cents per therm on Dec. 1 to 83.6 cents on Jan. 1.

An energy crunch in Europe and Asia has also contributed to the price squeeze. The benchmark price for natural gas in the European Union has quadrupled from one year ago.

Higher prices for natural gas have also contributed to steeper electricity rates for SDG&E customers because the utility uses gas to run some of its power plants. “On a 24-hour-a-day, 365 days-a-year basis, (natural gas is) still the majority of our power generation,” Crider said. “And because the cost of natural gas to use at our power plants has gone up, that has increased electricity prices.”

Another significant driver in higher rates, Crider said, is utility spending on a host of different programs.

SDG&E has spent about $3 billion through customer rates on wildfire mitigation since 2007’s deadly Witch, Guejito and Rice wildfires that killed 10 people and destroyed more than 1,700 homes. The money has gone to such safety measures as replacing wood poles with fire-resistant steel poles, undergrounding power lines in areas at higher risk for fire and establishing a network of more than 220 weather stations that provide grid operators real-time weather data.

Spending also goes to what’s called “public purpose programs,” directed and/or approved by the California Public Utilities Commission and implemented through surcharges added to utility bills.

These include energy efficiency programs, initiatives to help meet the state’s goal of deriving 100 percent of its electricity from carbon-free sources by 2045 and the costs associated with funding the California Alternate Rates for Energy, or CARE, and the Family Electric Rates Assistance, or FERA programs.

One of the most recent mandates came from the passing of Assembly Bill 841. Called the School Energy Efficiency Stimulus Program, it is designed to improve ventilation and energy efficiency at the scale needed to operate in light of the COVID-19 outbreak.

SDG&E and the state’s two other large investor-owned utilities — Southern California Edison and Pacific Gas & Electric — have also expended ratepayer funds on things like constructing electric vehicle charging stations and other efforts to decarbonize the state’s transportation sector. The Public Utilities Commission has authorized about $300 million for SDG&E’s portfolio.

“I think our customers, and certainly our regulators and stakeholders, expect us to continue to move more towards a clean energy system, which we’re making really good progress on,” Crider said.

Others are not as forgiving.

Bill Powers, board member of the San Diego-based Protect Our Communities environmental group, has been a frequent SDG&E critic and says the utility has been spending ratepayer dollars too freely. He points to the $3 billion put into its wildfire measures.

“It’s not the wood poles that started the fires in 2007,” Powers said. “The obvious low-cost solution is to equip all those folks (in the backcountry) with solar and batteries and whenever you have to shut off the existing system because there’s a fire threat, you do it and their backup systems kick in.

“They (SDG&E) have resisted that approach in every forum because it completely undermines the basis for spending billions ... It’s what I call ‘disaster capitalism.’”

SDG&E rates are the highest in California and among the highest in the country.

According to a Public Utilities Commission report, SDG&E’s average rate in 2020 for all customers — residential, commercial, industrial, those on discounted programs — came to 22.75 cents per kilowatt-hour. That was 5 cents higher than Pacific Gas & Electric and almost 8 cents higher than Southern California Edison.

SDG&E has cited a number of reasons for its higher rates, including:

- having fewer commercial and industrial sectors than PG&E and Edison, who make up a larger share of the energy load than residential customers, and

- having about 60 percent of its circuits and wires below ground, which are more expensive. The national industry average is about 40 percent.

SDG&E officials also point to numbers compiled by the federal government showing that while their rates are high, their bills tend be lower than their in-state rivals. The average monthly bill for SDG&E from November 2020 to October 2021 was $111, which was $6 less than Edison and $39 cheaper than PG&E.

SDG&E customers may soon see some relief from high natural gas prices. Pricing for customers in the gas market is updated on a monthly basis, SDG&E’s Crider said, so as temperatures warm going into spring and summer, supplies are likely to increase as demand for home heating slackens.

“We’re hopeful that as gas production increases, we’ll get some relief over time from this global shortage and then we can ultimately get some relief to our customers,” Crider said.

Even before the jump in natural gas prices, rates for California utility customers have been rising — and figure to keep escalating.

A paper released in May 2021 by the Public Utilities Commission predicted residential rates going up an average of 4.7 percent a year through 2030 for SDG&E, 3.7 percent per year for PG&E and 3.5 percent for Southern California Edison.

If it’s any consolation, increases in rates do not translate to more money for utilities.

That’s because since 1982, the state has decoupled the profit power companies make from the amount of power they sell to customers. The price of gas and electricity is a direct “pass-through” so the utilities don’t profit from how much the energy costs. Instead, the Public Utilities Commission sets a predetermined amount the utilities can make.

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.