- On EdTech Newsletter

- Posts

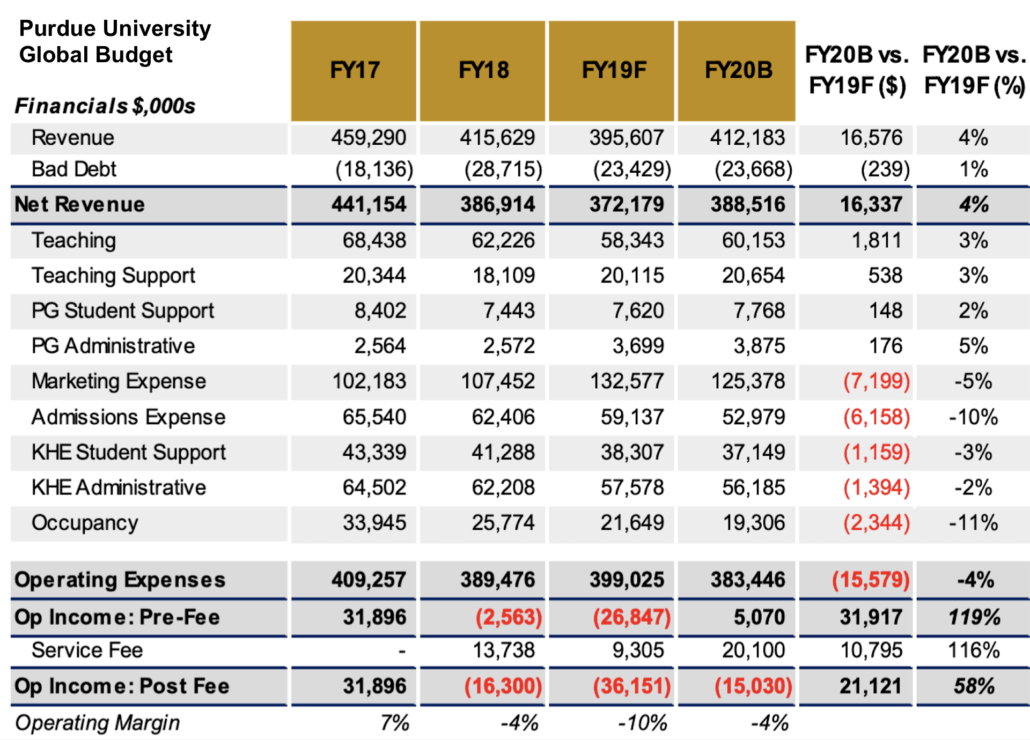

- Purdue Global Budget: More than $132m spent on marketing last year

Purdue Global Budget: More than $132m spent on marketing last year

I shared Purdue University’s 2019 Financial Report a few weeks ago, showing that Purdue University Global lost $43 million in its first full year of operation after the Kaplan University acquisition. In a postscript I noted:

The $28.5 million marketing investment does NOT imply that Purdue Global spent only that amount on marketing and will not need to in the future. What it means is that based on internal budgeting Purdue Global spent $28.5 million more than what they believe is a steady state marketing level, and that they believe they can go back down to steady state marketing in FY2020. [snip] this information indicates that Purdue Global likely spent more than $130 million on marketing in FY2019.

Last week the Chronicle ran an article on Purdue Global that seemed to contradict this information.

Purdue Global is a new name and, effectively, a new player in the increasingly competitive marketplace for adult learners. “Obviously, it’s hard to start a brand new university,” [Betty Vandenbosch, a former president of Kaplan University and now chancellor of Purdue Global] says. Purdue Global’s financial loss this year was due, in part, to nearly $30 million spent on marketing.

Making a big spend for marketing was “a logical, strategic decision,” said Tim Doty, the director of public information and issues management for Purdue, in an email. He added that Purdue Global expects to make a profit in fiscal year 2020 due to increased enrollment, better retention, and “normalized levels of investment in branding/marketing.”

Did Purdue Global spend roughly $30 million on marketing in 2019 or $130 million?

This question is more than a matter of semantics, as it gets at several important issues.

For the Indiana and Purdue community, are they aware of the level of marketing expense that is apparently required to stabilize, or turn around, the Purdue Global enrollment trends?

For those interested in the Online Program Management (OPM) market, what does this emerging segment of former-for-profit school conversions look like as a model, and is it something to be emulated or not? Spending less than $1,000 on marketing per student enrolled is quite different than spending more than $4,400 (marketing expense divided by 30,000 students), and this could be make-or-break distinction for other programs.

For those interested in online education in general, has this unique Purdue / Kaplan deal created a new mega-university, and is Purdue Global financially viable over the long term?

I, of course, am interested in all three sets of questions.

Purdue Response

I asked Tim Doty, my official contact at Purdue who has been very helpful thus far, to clarify this information last week, and unfortunately the response I got was a non-answer.

Purdue Global made a planned short-term start-up marketing investment of $28.5 million to help set the school up for success. That startup investment is no longer needed, which will return the spending side of the budget to normalized levels.

I have obtained a copy of the FY2020 budget For Purdue Global, showing actuals for previous years and budget for 2020, and this budget should answer the questions more clearly. Before sharing this document, I should describe some history on my Purdue document research to explain why I am sharing the budget document in this manner.

Purdue Document Requests

Purdue typically puts out its university Financial Report in October of each, but for some reason the report was not shared this year in the same fashion as before. Thanks to obsessive googling, I finally find a non publicized URL under the Board’s sub-folder. Since that first post came out, Purdue has put the Financial Report out in the normal public location. I have no idea if my post and the document release were related, but it is interesting timing.

For my reporting on the system-wide OPM contract between Purdue and Kaplan, which is outside of the scope of Purdue Global, I submitted a public records request in the fall and received that document in a reasonable time frame, albeit heavily redacted.

I have asked twice during this process to get the Purdue Global budget to clarify important issues such as the marketing spend and whether we should expect losses again this year. These requests have been unsuccessful.

Unfortunately, right before Purdue Global was approved in the Indiana state budget, there was a change made to exempt that school from public records laws such as Purdue University has to follow. As reported in The Journal & Courier in 2017 (“New U” was the reference to Purdue Global at the time):

But in legislation Purdue helped craft and put into hands of legislators, the “New U” is exempt from Indiana open door laws, access to public records laws and accounting for public funds codes – each on the books to offer basic public scrutiny that governs the state’s governmental bodies and universities, including Purdue.

“I wasn’t aware of it and haven’t seen anything like it for other state agencies or even quasi-state agencies,” said Luke Britt, who as Indiana’s public access counselor helps arbitrate what is and isn’t covered by open door and open records laws.

Purdue Global Budget Sheet

Below is the budget I have obtained for Purdue Global, which I believe is accurate. I would have preferred to share budget information provided by Purdue, but that is not forthcoming. Note the Fiscal Year runs July 1 through June 30 as with most US colleges and universities.

I notified Purdue University that I was going to publish this budget. In an email response Purdue stated:

Keep in mind there is a projected budget and actual spending. Actual marketing spending for FY2020 is on course to be less than the projected budget.

It’s also important to note that the broad marketing expense line includes funding for a variety of areas such as partnerships, student and alumni communities, websites and technologies, and research.

Clarity on Marketing Expense

This budget appears to confirm my reading of the marketing expense in FY2019. The marketing expense line item (note that the transfer from Kaplan to Purdue finalized spring 2018) for Kaplan University / Purdue Global has been over $100 million since at least 2017. There is an increase of more than $25 million in the marketing expenses line item to $132 million for Fiscal Year (FY) 2019, and then a planned reduction of just $7 million down to $125 million in FY2020. I have trouble seeing this drop qualifying as a return to normalized levels.

Note that I am not adding in the $59 million in “admissions expense” to this equation. That is a separate line item.

By way of comparison, the University of Florida Online has a marketing expense of $2.4 million for total enrollments of roughly 4,100 in FY2019. That comes out to $600 of marketing expense per enrolled student at UF Online, compared to $4,400 per enrolled student at Purdue Global. Southern New Hampshire University (SNHU) spends roughly $990 of marketing expense per enrolled student, although it is not clear if that number includes “admissions expense”. Purdue Global’s marketing expense is extraordinarily high, especially for a nonprofit university.

Questions on Profitability

Furthermore, the budget seems to contradict Purdue’s statements “that Purdue Global expects to make a profit in fiscal year 2020 due to increased enrollment, better retention, and ‘normalized levels of investment in branding/marketing.’”. The FY2020 budget shows a loss of roughly $15 million. How to explain this discrepancy?

I believe that Purdue was describing an operating surplus before taking into account the revenue-share fee to Kaplan (the “service fee” line). That approach is misleading, as the service fee is a planned expense and part of how they negotiated to buy Kaplan University for $1.

This question leads us to the second page of the budget, the one that covers the “service fee” portion of the payments to Kaplan. Keep in mind that Purdue pays Kaplan directly as a fee-for-service for most line items in the budget above, as described in my original post.

Extrapolating this number for a full 12 months, Kaplan HE as an OPM is likely making close to $315 million in revenue from the Purdue agreement, out of Purdue Global’s roughly $437 million in operating expenses. While Kaplan’s case is unique, that is still a large OPM operation, especially from just one client.

The service fee is the revenue-sharing portion on top of the fee-for-service – set at 12.5% – and there are provisions in the agreement stipulating where Kaplan would defer a portion of the fee until Purdue Global is truly profitable, and where Kaplan would forego a portion of the fee.

The KHE Service Fee Calculated line is simple. Take the Net Revenue line from the budget sheet and calculate the 12.5% revenue sharing portion of their agreement ($372 million * 12.5% = $46.5 million for FY 2019, etc). For FY2019 (as described in the first post), Kaplan deferred $9 million of their fee until such time that Purdue Global can pay it out of profits. It is a liability. What we can now see is that Kaplan Higher Education (KHE) had to also forego $37 million of the fee for last year. For FY2020, they are budgeted to defer nearly $10 million and forego another $28 million.

Purdue Global’s budget includes $20 million in KHE service fee. This is the combination of $10.4 million paid to KHE and $9.7 deferred but included in the budget.

Questions on Viability

What I believe this budget shows is that any excess operating gains from Purdue Global will go to Kaplan Higher Education until such time as all deferred payments are paid and KHE no longer has to forego the remainder of the fee. Only then will Purdue Global start making “profits”.

Put simply, I do not believe that Purdue Global has yet proven itself to be viable in the long term. It is running on IOUs and foregone payments to its OPM partner, Kaplan Higher Education. And it will be very difficult to get to the point of true profitability and financial viability as long as Purdue Global has to continue spending more than $4,400 per enrolled student just on marketing expense.

The post Purdue Global Budget: More than $132m spent on marketing last year appeared first on Phil Hill & Associates.