ESIC employer login

What is ESIC?

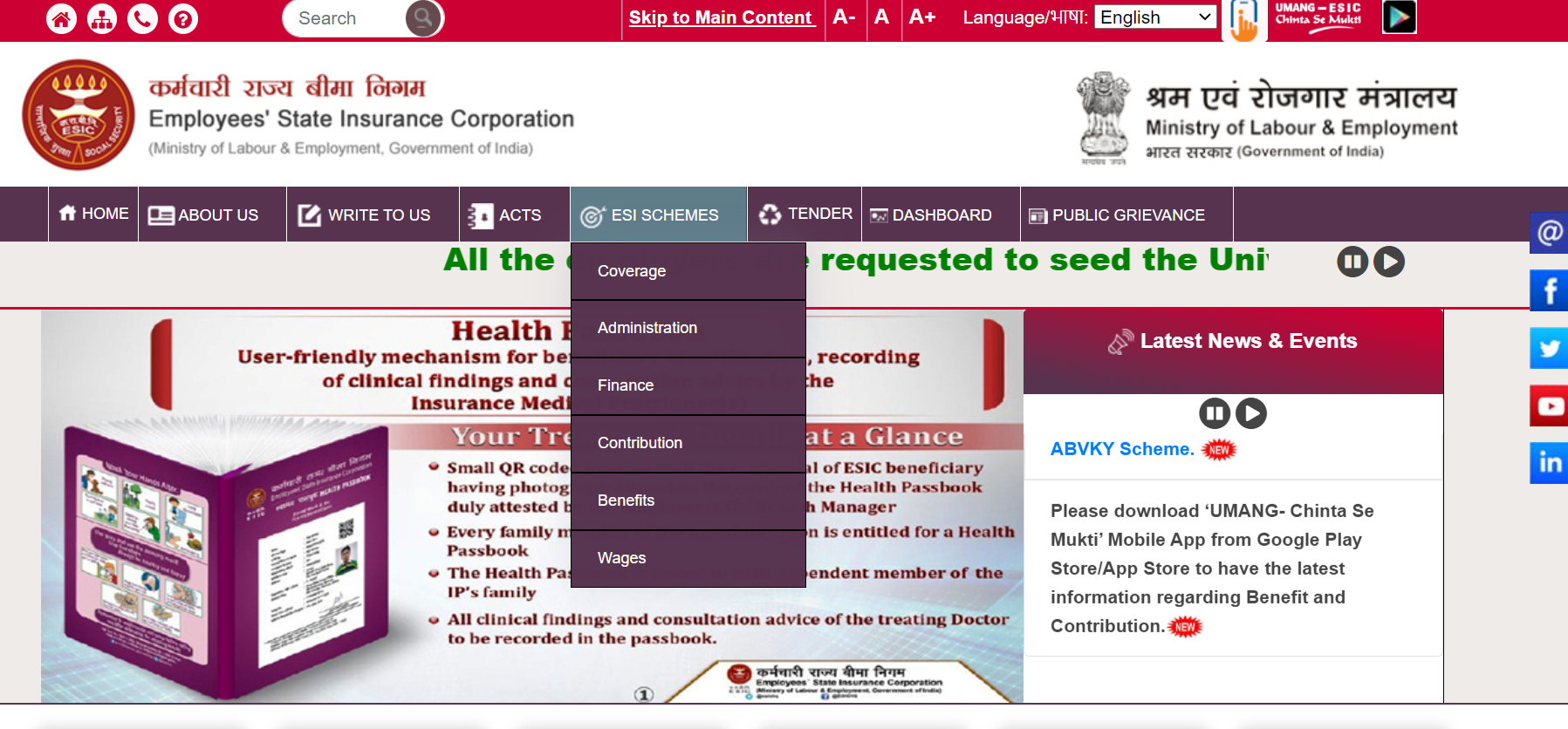

ESI stands for Employees’ State Insurance Corporation. It is a self financing social security and health insurance scheme for Indian workers. ESIC is managed by employee state insurance corporation. It functions according to according to rules and regulations stipulated in ESI act, 1948. ESIC is a autonomous body and comes under Ministry of Labor and Employment. ESIC can be accessed at ESIC portal. In this article, we would look into steps required for ESIC employer login.

ESIC Employer login

ESIC employer login is available for all the employers who have registered on ESIC portal. Employers first need to register on ESIC portal. Let us look at different steps need to performed for ESIC login-

- Visit the official ESIC portal and click on “Employer Login” option on the page.

- You would need to fill sign up page on the ESIC portal page by filling all relevant details.

- You need to provide necessary details such as company name, principal employer name, email and phone number. Select the state and regions. Submit the form.

- You will get all necessary details such as login ID and password on your registered email id and mobile number

- Now you need to go to the ESIC portal and sign in by clicking on the ‘Employer Login’ option using the login credentials. On the new page, click on “New employer registration”

- You need to select type of unit and then click on submit under this step for ESIC employer login

- Now, you will be asked to fill Employer Registration – Form 1. Complete this application form by completing all relevant details

- Now, you will be asked to pay ESIC advance contribution under ESIC rules. An employer who is registered under ESIC, need to pay advance for six months of ESIC contribution post ESIC login.

- Upon successful registration on ESIC portal, ESIC would send registration letter (C-11) on registered address of the employer registered with ESIC. This registration letter serves as a proof for employer registration with ESIC. ESIC registration certificate would consists of 17 digit unique number for ESIC employer contribution

Documents required for ESIC employer login registration

An employer should be able to submit following documents at the time of ESIC employer login registration-

- PAN card of institution as well as all of its employees

- Bank statement of the company with an registered bank

- Registration certificate or license issued under the Shops and Establishments Act/Factories Act

- Proof of address such as electricity bill and sale deed

- Copy of property tax receipts

- Partnership Deed or Trust Deed, Memorandum and Articles of Association of the company depending on the type of entity

- List of directors and shareholders

- GST registration certificate

ESIC contribution

Both employee as well as employer need to contribute into ESIC. Both ESIC employee contribution and ESIC employer contribution rates are updated from time to time and stands as follows at the time of writing this article on ESIC login –

- ESIC Employer contribution – 3.25%

- ESIC employee contribution – .75%

In this article, we have looked into different steps and documents required for ESIC employer login registration. If you want to read further articles on ESIC, you can visit our detailed page on ESIC here