Get the free mtaa super withdrawal form

Show details

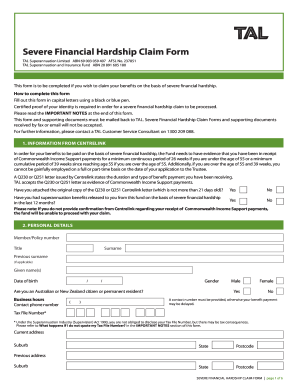

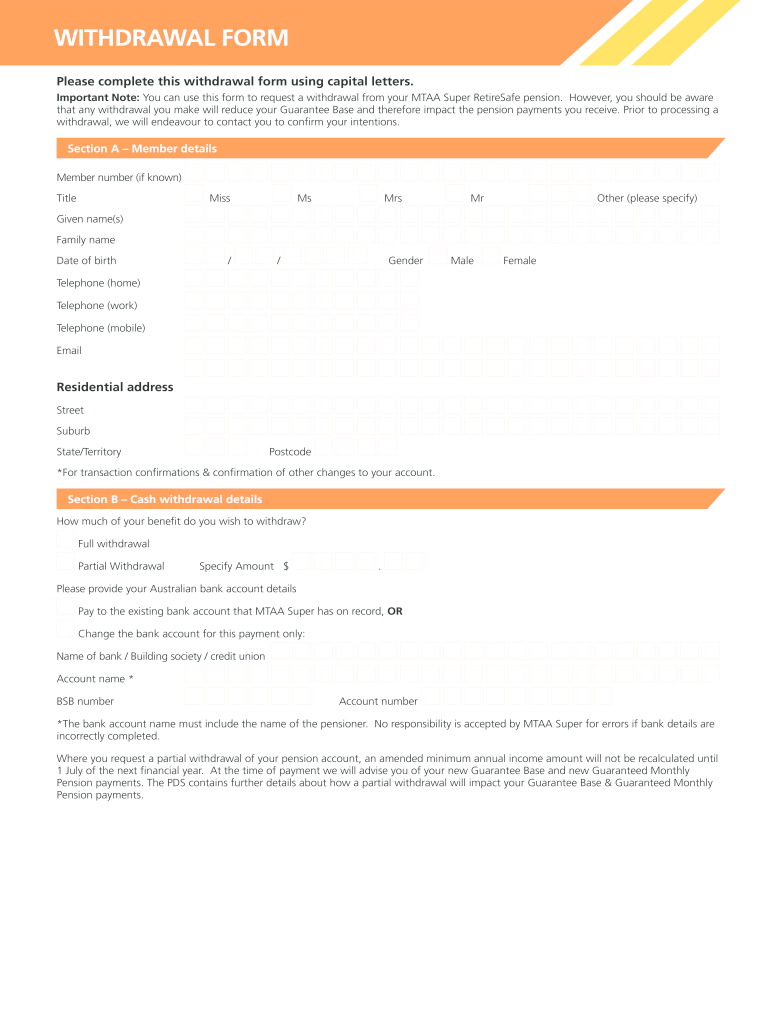

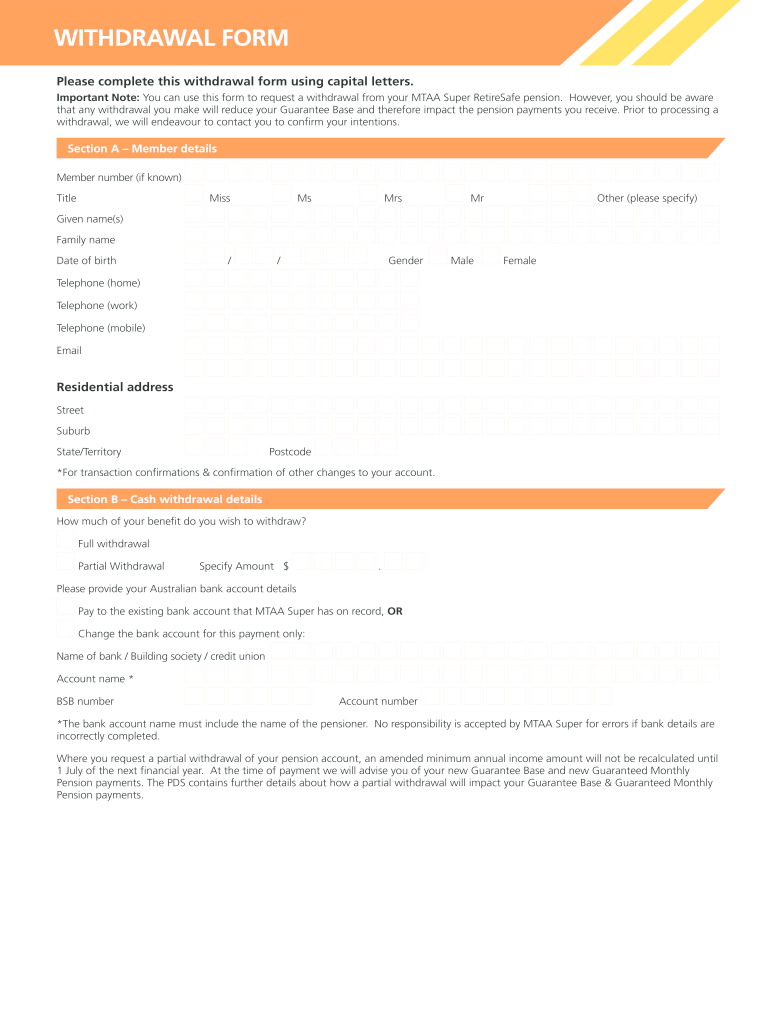

WITHDRAWAL FORM Please complete this withdrawal form using capital letters. Important Note: You can use this form to request a withdrawal from your MTA Super Retires pension. However, you should be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mtaa super withdrawal form

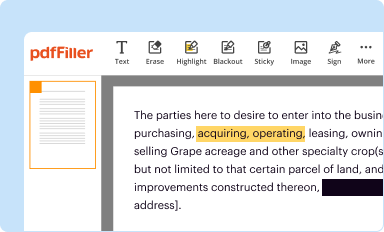

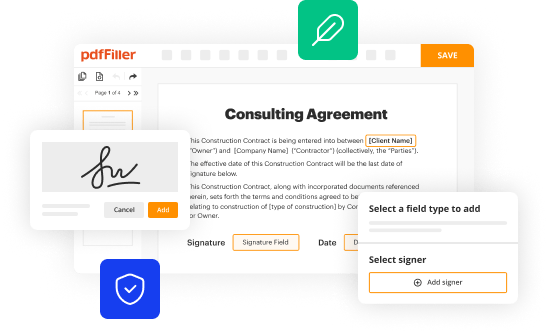

Edit your rest super withdrawal forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

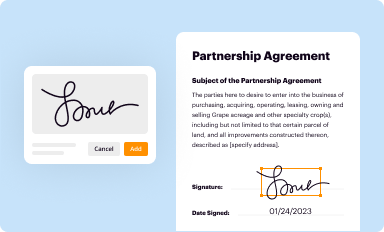

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mtaa super rollover form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mtaa online online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mtaa online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mtaa forms

How to fill out AU MTAA Super Withdrawal Form

01

Download the AU MTAA Super Withdrawal Form from the official website.

02

Provide your personal details, including name, address, date of birth, and contact information.

03

Enter your superannuation account details, such as your fund name and member number.

04

Specify the amount you wish to withdraw from your super fund.

05

Indicate the reason for the withdrawal, based on the options provided in the form.

06

Attach any required documentation that supports your reason for withdrawal.

07

Review all the information you've entered to ensure it's accurate.

08

Sign and date the form where indicated.

09

Submit the completed form along with any attachments to your super fund via the provided address or electronic means.

Who needs AU MTAA Super Withdrawal Form?

01

Individuals who are experiencing financial hardship and need access to their superannuation funds.

02

Members who are approaching retirement and wish to withdraw their super.

03

People who have permanent incapacity and need to access their super benefits.

04

Those who are transitioning from temporary residency and want to claim their super.

Fill

mtaa application form

: Try Risk Free

People Also Ask about australiansuper partial withdrawal form

Can I close my super account and withdraw money?

You can withdraw your super if you're. 65 years or over, whether you keep working or not. 60 or over and change employers or temporarily stop working. Under 60 and have permanently stopped working, and you've met your preservation age.

Can I withdraw my super if I leave Australia permanently?

If you're an Australian citizen leaving permanently, the same rules apply to your super, as if you were living in Australia. This means your super must stay in your super fund(s) until you are eligible to access it.

Can I cash out my Australian super?

The minimum amount that can be withdrawn is $1,000 and the maximum amount is $10,000. If your super balance is less than $1,000 you can withdraw up to your remaining balance after tax. You can only make one withdrawal in any 12-month period.

Can I take money out of my Super Australian Super?

You may be able to withdraw some of your super if you are experiencing severe financial hardship. There are no special tax rates for a super withdrawal because of severe financial hardship. Withdrawals are paid and taxed as a normal super lump sum.

How long does it take to withdraw from Australian super?

If you've reached the age you can legally access your super (preservation age) plus 39 weeks you can apply to withdraw as much of your super as you wish if: you've been receiving eligible Commonwealth income support payments for a cumulative period of at least 39 weeks since reaching your preservation age; and.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my australian super withdrawal form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your australian super rollover form pdf and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit australiansuper partial withdrawal form pdf in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your australiansuper withdrawal online, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete australiansuper withdrawal form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your australiansuper withdrawal form online. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AU MTAA Super Withdrawal Form?

The AU MTAA Super Withdrawal Form is a document used by members of the MTAA Superannuation Fund in Australia to request the withdrawal of their superannuation savings.

Who is required to file AU MTAA Super Withdrawal Form?

Individuals who are members of the MTAA Superannuation Fund and wish to withdraw their superannuation funds are required to file this form.

How to fill out AU MTAA Super Withdrawal Form?

To fill out the AU MTAA Super Withdrawal Form, individuals need to provide their personal details, member number, the amount they wish to withdraw, and specify the reason for the withdrawal. It's also important to sign and date the form before submitting it.

What is the purpose of AU MTAA Super Withdrawal Form?

The purpose of the AU MTAA Super Withdrawal Form is to formally request the release of superannuation funds for specific reasons, such as financial hardship, increased age, or other eligible conditions.

What information must be reported on AU MTAA Super Withdrawal Form?

The information that must be reported on the AU MTAA Super Withdrawal Form includes the applicant's personal identification details, member account number, the amount requested for withdrawal, the reason for withdrawal, and the applicant's signature.

Fill out your AU MTAA Super Withdrawal Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australiansuper Withdrawal Form Pdf Download is not the form you're looking for?Search for another form here.

Keywords relevant to australiansuper withdrawal form pdf

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.