- What is Form 26AS?

- Information Available on Form 26AS

- Structure and Parts of Form 26AS

- How to View Form 26AS?

- Download Form 26AS Format for FY 2024-25

- Download Form 26AS through Income Tax Portal

- View Form 26AS from Net Banking Facility

- Benefits of Form 26AS

- Introduction of Annual Information Statement (AIS)

- 26AS v/s AIS

- TDS Certificate (Form 16/16A) and Form 26AS

- Things to verify in TDS certificate with Form 26AS

- Frequently Asked Questions

Form 26AS - What is Form 26AS? View And Download Form 26AS Online

Form 26AS is a statement that provides details of any amount deducted as TDS or TCS from various sources of income of a taxpayer. It also reflects details of advance tax/self-assessment tax paid, and high-value transactions entered into by the taxpayer. The scope of the statement has now been expanded to include details of foreign remittances, mutual funds purchases, dividends, refund details, turnover as per GST records, etc.

Form 26AS gives a consolidated record of every tax-related information associated with your PAN (Permanent Account Number). It can be viewed and downloaded easily from the TRACES website. Login to the income tax portal, go to e-file, Income Tax Returns, View form 26AS. You will be redirected to TRACES website. Click on the ‘View Tax credit statement’, enter the assessment year, view as HTML, and click on ‘export to PDF’.

What is Form 26AS?

- Form 26AS is the annual tax statement provided by the Income Tax Department to every taxpayer.

- It is a consolidated statement which contains all the high value transactions, TDS deducted, TCS collected, corresponding income, refund issued, default if any on the TDS payments, turnover details if you are a GST registered business.

- Form 26AS is considered an important and convenient document for tax filing, as it contains most of the required information at one place.

- Income tax filing can be done without Form 26AS, since it is not a mandatory document for tax filing. But it is highly recommended to have Form 26AS handy while filing the returns, as chances of getting an Income Tax notice is high, even if a miniscule transaction reflected in the form is missed out in the returns.,

Information Available on Form 26AS

Form 26AS is a statement that shows the below information:

- Details of tax deducted at source

- Details of tax collected source

- Advance tax paid by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by the taxpayers (PAN holders)

- Details of income tax refund received by you during the financial year

- Details of the high-value transactions regarding shares, mutual funds, etc.

- Details of tax deducted on sale of immovable property

- Details of TDS defaults (after processing TDS return) made during the year

- Turnover details reported in GSTR-3B

- Details of specified financial transactions

- Pending and completed income-tax proceedings

Structure and Parts of Form 26AS

PART-I Details of Tax Deducted at Source

- TDS on salary, business, profession, interest income etc., shall be reported here

PART-II Details of Tax Deducted at Source for 15G/15H

- TDS on which no TDS is made because of Form 15G/15H due to income being less than the basic exemption limit. Mainly applicable for senior citizen taxpayers

PART-III Details of Transactions under Proviso to section 194B/First Proviso to sub-section (1) of section 194R/ Proviso to sub-section(1) of section 194S

- TDS made on payment made in kind (car in a lottery, foreign trips for meeting sales targets etc.)

PART-IV Details of Tax Deducted at Source u/s 194IA/ 194IB / 194M/ 194S (For Seller/Landlord of Property/Contractors or Professionals/ Seller of Virtual Digital Asset)

- TDS made on sale of house property/rent payment in excess of Rs. 50,000 per month, payment to a contractor/professional services in excess of Rs.50 lakhs/sale of virtual digital asset (cryptocurrency)

PART-V Details of Transactions under Proviso to sub-section(1) of section 194S as per Form-26QE (For Seller of Virtual Digital Asset)

PART-VI Details of Tax Collected at Source

- TCS made under various sections of 206C

PART-VII Details of Paid Refund (For which source is CPC TDS. For other details refer AIS at E-filing portal)

PART-VIII Details of Tax Deducted at Source u/s 194IA/ 194IB /194M/194S (For Buyer/Tenant of Property /Person making payment to contractors or Professionals / Buyer of Virtual Digital Asset)

- These details consist of the TDS made by you in relation to the purchase of house property/rent payment in excess of Rs. 50,000 per month, payment to a contractor/professional services in excess of Rs.50 lakhs/purchase of virtual digital asset (cryptocurrency). This is just for information purposes.

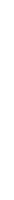

PART-IX Details of Transactions/Demand Payments under Proviso to sub-section(1) of section 194S as per Form 26QE (For Buyer of Virtual Digital Asset)

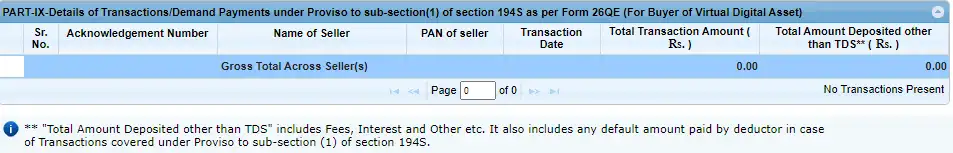

PART-X TDS/TCS Defaults* (Processing of Statements)

- TDS defaults value (after processing of TDS returns) but do not include demands raised by the assessing officer.

How to View Form 26AS?

You can view Form 26AS through the following two modes:

- Income tax portal

- The net banking facility of your bank account

Download Form 26AS Format for FY 2024-25

Download Form 26AS format for FY 2024-25 (AY 2025-26)

Download Form 26AS through Income Tax Portal

Form 26AS can be downloaded on the TRACES website. Below are the steps to view and download Form 26AS from the TRACES website.

Step 1: Visit the e-filing website

Step 2: Enter your user ID- It can be either PAN or Aadhaar number. If the user ID is invalid, error message will be displayed. Continue with valid user ID details.

Step 3: Enter the password and continue.

Step 4:

- The following screen will appear. Go to ‘e-file’. Click on ‘Income Tax Returns’ and select ‘View Form 26AS’ in the drop-down.

- View Form 26AS

Step 5:

- Click on ‘Confirm’ to the disclaimer so that you are redirected to the TRACES website (don’t worry, this is a necessary step and is completely safe since it is a government website).

- TRACES Website

Step 6: You are now on the TRACES (TDS-CPC) website. Select the box on the screen and click on ‘Proceed’.

Step 7: Click on the link at the bottom of the page – Click ‘View Tax Credit (Form 26AS)’ to view your Form 26AS.

Step 8: Choose the Assessment Year and the format you want to see Form 26AS. If you want to see it online, leave the format as HTML. You can also choose to download it as a PDF. After you have made your choice, enter the ‘Verification Code’ and click on the ‘View/Download’ button.

Alternatively, Form 26AS can be downloaded by directly logging into TRACES portal. Form 26AS is not a password encrypted file.

View Form 26AS from Net Banking Facility

The facility to view Form 26AS is available to a PAN holder having a net banking account with any authorised bank. You can view your Form 26AS only if your PAN number is linked to that particular account. This facility is available for free. The list of banks registered with NSDL through which you can view your Tax Credit Statement (Form 26AS) are as below:

- Axis Bank Limited

- Bank of India

- Bank of Maharashtra

- Bank of Baroda

- Citibank N.A.

- Corporation Bank

- City Union Bank Limited

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Overseas Bank

- Kotak Mahindra Bank Limited

- Indian Bank

- Karnataka Bank

- Oriental Bank of Commerce

- State Bank of India

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Patiala

- The Federal Bank Limited

- The Saraswat Co-operative Bank Limited

- UCO Bank

- Union Bank of India

Benefits of Form 26AS

- Form 26AS provides important information about tax deducted/collected and deposited with the government tax authorities by the authorized deductors /collectors.

- A taxpayer can view all financial transactions involving TDS/TCS for the relevant financial year in Form 26AS.

- Form 26AS helps in the computation of income and to claim the tax credits when filing an Income Tax Return (ITR) on income.

- Form 26AS helps in the computation of income and to claim the tax credits at the time of filing Income Tax Return (ITR) on income.

- A taxpayer can confirm the verification of refunds during the applicable financial or assessment year using Form 26AS.

Introduction of Annual Information Statement (AIS)

Now again, the tax department has introduced an Annual Information Statement (AIS) to incorporate new details like foreign remittances, off-market transactions, interest on income tax refunds, mutual fund purchases and dividend details, and break-up details of salary and ITR information of another person.

The income tax department used to already avail these records from the authorized entities.

Further, salary break-up details are available in Form 16 from details uploaded by employers on the TRACES portal.

Moreover, information related to certain transactions undertaken by the taxpayers is available with the tax department through ITR filed by others. For example, the property seller reports buyers' details in their ITR.

26AS v/s AIS

Generally, there should be no discrepancies between Form 26AS and AIS. However, if any inconsistencies do arise, the income tax department's press release on the introduction of AIS will take precedence. As per the aforesaid press release, in case of conflict arising between AIS and 26AS ,the information in Form 26AS will prevail. It's important to verify the accuracy of the numbers in both statements based on available information. Form 26AS should only prevail when the taxpayer lacks sufficient information or when it's necessary to rely on the data available in the portal.

TDS Certificate (Form 16/16A) and Form 26AS

A TDS certificate or Form 16/16A and Form 26AS have different purposes though they may seem to contain the same information. Form 16/16A is the certificate of TDS or TCS that is issued by the deductor which serves as an evidence that tax deducted or collected by him is deposited to the government under your PAN. Whereas, Form 26AS contains all relevant information related to TDS/TCS sufficient to file ITR. However, there is a need to obtain a TDS Certificate. The rationale behind introducing Form 26AS was to enable the taxpayers to cross-check and verify their details in the TDS certificates with the details recorded in Form 26AS and maintain transparency of information.

When you do not have a TDS certificate or Form 26AS, you cannot verify your details and find mismatches that may have occurred. When you have both, you can cross-check, compare the details and find discrepancies, if any. In the case there are discrepancies, you can get it corrected.

Further, in the case of salaried persons, Form 26AS is not sufficient to file ITR since it does not show the break-up of the income and deductions claimed under Section 80C to Section 80U which are available in TDS certificate. Thus, you need a TDS certificate along with Form 26AS.

Things to verify in TDS certificate with Form 26AS

Form 26AS must be verified with the details of TDS certificate, i.e. Form 16 (for salaried individuals) and Form 16A (for non-salaried individuals), to ensure that the TDS deducted from the payee’s income was deposited with the income tax department.

Other things that taxpayers must verify in the TDS certificate and Form 26AS are as follows:

- Check the name, PAN number, deductor’s TAN, refund amount and TDS amount to ensure that they are correctly reflected. A mismatch in details may create problems while filing ITR.

- Check if the TDS mentioned in Form 16/16A is reflecting in Form 26AS correctly. When the TDS shown in the TDS certificate is not reflecting in Form 26AS, it means that the deductor has deducted the tax on your behalf but has not deposited it with the income tax department. In such a case, you need to take action and contact the deductor to rectify it.

In the case of any discrepancy between the TDS certificate and Form 26AS, inform your deductor and get it corrected immediately. Ensure that the deductor has filed TDS using your PAN number and other details. In many cases, if the TDS is filed under an incorrect PAN, it can result in problems for you and the deductor.

You Might be Interested in

File ITR

ITR U Form

SIP (Systematic Investment Plan)

SIP Calculator

Income Tax

Invest in Mutual Funds

Stock Market Live

UAN Login