RHB - Osk188

RHB - Osk188

RHB - Osk188

Transform your PDFs into Flipbooks and boost your revenue!

Leverage SEO-optimized Flipbooks, powerful backlinks, and multimedia content to professionally showcase your products and significantly increase your reach.

\The c<br />

Mohammad Ashraf Abu Bakar, CMT<br />

Tel : +6(03)9207 7699<br />

Email : ashraf.abubakar@my.oskgroup.com<br />

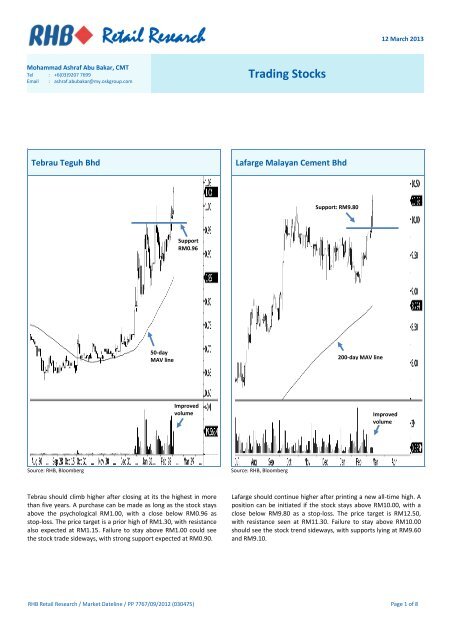

Tebrau Teguh Bhd<br />

Resistance: RM1.65<br />

50-day<br />

MAV line<br />

Support<br />

RM0.96<br />

Improved<br />

volume<br />

Source: <strong>RHB</strong>, Bloomberg Source: <strong>RHB</strong>, Bloomberg<br />

Tebrau should climb higher after closing at its the highest in more<br />

than five years. A purchase can be made as long as the stock stays<br />

above the psychological RM1.00, with a close below RM0.96 as<br />

stop-loss. The price target is a prior high of RM1.30, with resistance<br />

also expected at RM1.15. Failure to stay above RM1.00 could see<br />

the stock trade sideways, with strong support expected at RM0.90.<br />

<strong>RHB</strong> Retail Research / Market Dateline / PP 7767/09/2012 (030475)<br />

Trading Stocks<br />

Lafarge Malayan Cement Bhd<br />

Support: RM9.80<br />

200-day MAV line<br />

12 March 2013<br />

Improved<br />

volume<br />

Lafarge should continue higher after printing a new all-time high. A<br />

position can be initiated if the stock stays above RM10.00, with a<br />

close below RM9.80 as a stop-loss. The price target is RM12.50,<br />

with resistance seen at RM11.30. Failure to stay above RM10.00<br />

should see the stock trend sideways, with supports lying at RM9.60<br />

and RM9.10.<br />

Page 1 of 8

Berjaya Food Bhd<br />

Resistance: RM2.35<br />

100-day MAV line<br />

Source: <strong>RHB</strong>, Bloomberg Source: <strong>RHB</strong>, Bloomberg<br />

Berjaya Food may continue higher after posting a 3-month high. A<br />

purchase can be made if the stock stays above RM1.25, with a close<br />

below RM1.20 as stop-loss. The price target is RM1.60, with<br />

resistance also expected at the psychological RM1.50. The stock<br />

may decline if the stop-loss is triggered, with supports lying at<br />

RM1.15 and a stronger one at RM1.05.<br />

See important disclosure notice at the end of report<br />

Support<br />

RM1.20<br />

Improved<br />

volume<br />

Malaysian Bulk Carriers Bhd<br />

Resistance: RM1.40<br />

200-day MAV line<br />

Support<br />

RM1.50<br />

Improved<br />

volume<br />

Malaysian Bulk may rebound after posting a five-month high last<br />

week. A position can be initiated if the stock stays above RM1.55,<br />

with a close below RM1.50 as stop-loss. The price targets are the<br />

prior highs of RM1.70 and RM1.80. Should the stock fail to stay<br />

above RM1.50, it may trend sideways, with supports seen at<br />

RM1.45 and RM1.35.<br />

Page 2 of 8

Hua Yang Bhd<br />

Support: RM0.725<br />

See important disclosure notice at the end of report<br />

Resistance :<br />

RM1.75<br />

200-day MAV line<br />

Improved<br />

volume<br />

Dijaya Corp Bhd<br />

Source: <strong>RHB</strong>, Bloomberg Source: <strong>RHB</strong>, Bloomberg<br />

Hua Yang should continue to scale higher after printing a new alltime<br />

high. A position can be initiated if the stock closes above<br />

RM1.75, with a close below RM1.65 as stop-loss. The price target is<br />

the psychological RM2.00, with resistance anticipated at RM1.85.<br />

However, the stock may decline if it triggers the stop-loss, with<br />

supports lying at RM1.55 and a stronger one at RM1.50.<br />

Support: RM1.50<br />

Resistance<br />

RM2.55<br />

50-day MAV line<br />

Dijaya’s downside risk increased after it failed to nullify the weak<br />

bias of 7 Mar’s “Shooting Star”. Traders can liquidate if the stock<br />

closes below RM1.50, with supports anticipated at RM1.42 and a<br />

stronger one at RM1.34. Buying support could, however, continue if<br />

the stock closes above RM1.55. Resistances lie at RM1.60, with a<br />

stronger one at RM1.70.<br />

Page 3 of 8

I-Bhd<br />

Resistance RM0.86<br />

100-day MAV line<br />

Source: <strong>RHB</strong>, Bloomberg Source: <strong>RHB</strong>, Bloomberg<br />

I-Bhd should march higher after printing a new 52-week high. A<br />

position can be initiated above RM1.40, with a close below RM1.40<br />

as stop-loss. The price target is RM1.70, with resistance also<br />

expected at RM1.60. Failure to stay above RM1.40 should see the<br />

stock trade sideways, with strong support found at RM1.30.<br />

See important disclosure notice at the end of report<br />

Support:<br />

RM1.40<br />

High<br />

volume<br />

SapuraKencana Petroleum Bhd<br />

Support<br />

RM2.94<br />

Resistance:<br />

RM0.90<br />

50-day MAV line<br />

Improved<br />

volume<br />

SapuraKencana’s rally may resume as the stock has stayed above<br />

the 50-day MAV line for a few days. A purchase can be made as long<br />

as it stays above RM3.00, with a close below RM2.94 as stop-loss.<br />

The price target is RM3.30, if the recent high of RM3.15 is violated.<br />

Failure to stay above RM3.00 should see the stock trade sideways,<br />

with the downside bias intensifying on a close below RM2.85.<br />

Page 4 of 8

February and March’s Trading Stocks<br />

Stock<br />

OSK188<br />

Ticker<br />

1st<br />

Target<br />

2nd<br />

Target<br />

Cut-loss /<br />

Buyback<br />

Recommendation<br />

AEON Co AEON RM14.00 RM15.00 RM12.80 Buy on rebound continuation above RM13.00<br />

AEON Credit Services AEONCR RM13.00 RM13.70 RM11.20 Buy on rebound continuation above RM12.00<br />

AirAsia AIRASIA RM3.00 RM3.20 RM2.77 Buy above RM2.80 on possible bottom at RM2.77<br />

Alliance Fin Group AFG RM4.65 RM4.40 RM4.20 Buy above RM4.30 on possible bottom at RM4.20<br />

Apex Healthcare AHEALTH RM4.20 RM4.50 RM3.65 Buy on rally continuation above RM3.80<br />

Astro Malaysia Hldg ASTRO RM2.70 RM2.60 RM2.80 Sell as long as it stays below RM2.80 resistance<br />

Axiata AXIATA RM6.60 RM6.80 RM6.20 Buy above RM6.30 on possible bottom at RM6.20<br />

Axis REIT AXREIT RM3.30 RM3.50 RM3.10 Buy on rally continuation above RM3.20<br />

Benalec Holdings BENALEC RM1.10 RM1.05 RM1.21 Sell below RM1.21 on possible top at RM1.21<br />

Bertam Alliance BERTAM RM0.64 RM0.69 RM0.60 Buy above RM0.60 on possible bottom at RM0.60<br />

BIMB Holdings BIMB RM3.30 RM3.50 RM3.00 Buy above RM3.10 on possible bottom at RM3.00<br />

BLD Plantations BLDPLNT RM9.00 RM9.40 RM8.20 Buy on rebound continuation above RM8.50<br />

Bolton BOLTON RM0.75 RM0.70 RM0.85 Sell below RM0.85 on possible top at RM0.85<br />

Borneo Oil BORNOIL RM0.33 RM0.30 RM0.40 Sell below RM0.40 on possible top at RM0.40<br />

Boustead Heavy Ind BHIC RM1.75 RM1.50 RM2.20 Sell on break of 12-month low of RM2.00<br />

Bursa Malaysia BURSA RM7.00 RM7.50 RM6.55 Buy on rebound continuation above RM6.65<br />

Cahya Mata Sarawak CMSB RM3.25 RM3.50 RM3.00 Buy above RM3.03 on possible bottom at RM3.00<br />

Calrsberg Brewery CARLSBG RM14.00 RM14.70 RM12.80 Buy on rally continuation above RM13.20<br />

Can-One CANONE RM2.05 RM1.93 RM2.45 Sell below RM2.34 on possible top at RM2.45<br />

CB Industrial Product CBIP RM2.40 RM2.30 RM2.62 Sell on break of 6-month low of RM2.62<br />

CBSA CBSA RM0.48 RM0.50 RM0.44 Buy on rally continuation above RM0.45<br />

Censof Holdings CENSOF RM0.35 RM0.33 RM0.40 Sell below RM0.40 on possible top at RM.425<br />

China Stationary CSL RM0.64 RM0.58 RM0.80 Sell below RM0.80 on possible top at RM0.80<br />

CIMB Group CIMB RM6.85 RM6.70 RM7.00 Sell on break of 12-month low of RM7.00<br />

Coastal Contract COASTAL RM2.15 RM2.25 RM1.97 Buy above RM2.00 on possible bottom at RM1.97<br />

Cocoaland Holdings COCOLND RM2.27 RM2.35 RM2.00 Buy above RM2.10 on possible bottom at RM2.00<br />

Crecendo Corp CRESNDO RM2.00 RM2.20 RM1.73 Buy above RM1.80 on possible bottom at RM1.73<br />

Crest Builder Hldg CRESBLD RM0.90 RM0.95 RM0.78 Buy above RM0.80 on possible bottom at RM0.775<br />

Daibochi Plastic DAIBOCI RM2.70 RM2.85 RM2.45 Buy above RM2.55 on possible bottom at RM2.45<br />

Dayang Enterprise DAYANG RM2.55 RM2.70 RM2.35 Buy above RM2.40 on possible bottom at RM2.35<br />

Deleum DELEUM RM2.20 RM2.40 RM1.90 Buy on rally continuation above RM2.00<br />

Dialog DIALOG RM2.15 RM2.00 RM2.37 Sell below RM2.30 on possible top at RM2.35<br />

DiGi.com DIGI RM5.00 RM5.20 RM4.50 Buy above RM4.60 on possible bottom at RM4.50<br />

DKSH Holdings DKSH RM2.80 RM3.00 RM2.50 Buy above RM2.50 on possible bottom at RM2.50<br />

DRB Hicom DRBHCOM RM2.65 RM2.80 RM2.40 Buy above RM2.50 on possible bottom at RM2.40<br />

Dutch Lady Milk Ind DLADY RM44.50 RM46.50 RM42.00 Buy above RM42.50 on possible bottom at RM42.00<br />

Eden Inc EDEN RM0.25 RM0.22 RM0.30 Sell below RM0.30 on possible top at RM0.32<br />

Eng Kah Corp ENGKAH RM3.60 RM3.75 RM3.30 Buy above RM3.40 on possible bottom at RM3.30<br />

Faber Group FABER RM1.65 RM1.80 RM1.47 Buy on close above 6-month resistance of RM1.55<br />

Favelle Favco FAVCO RM1.40 RM1.30 RM1.61 Sell on break of 5-month low of RM1.61<br />

Felda Global Ventures FGV RM4.30 RM4.20 RM4.50 Sell below RM4.50 on possible top at RM4.50<br />

Gamuda GAMUDA RM3.90 RM4.00 RM3.67 Buy above RM3.75 on possible bottom at RM3.67<br />

Gas Malaysia GASMSIA RM2.85 RM2.93 RM2.69 Buy on close above 6-month resistance of RM2.75<br />

Genting GENTING RM10.30 RM10.70 RM9.55 Buy on rebound continuation above RM9.80<br />

Genting Malaysia GENM RM3.80 RM3.95 RM3.52 Buy above RM3.60 on possible bottom at RM3.52<br />

Genting Plantations GENP RM8.85 RM9.20 RM8.15 Buy above RM8.30 on possible bottom at RM8.15<br />

Glomac GLOMAC RM1.00 RM1.05 RM0.86 Buy on close above 12-month resistance of RM0.90<br />

Hartalega Hldg HARTA RM5.10 RM5.30 RM4.60 Buy above RM4.75 on possible bottom at RM4.60<br />

Ho Hup Construction HOHUP RM0.60 RM0.55 RM0.70 Sell on break of 6-month low of RM0.66<br />

icapital.biz ICAP RM2.20 RM2.10 RM2.31 Sell on break of 4-month low of RM2.28<br />

IGB Corp IGB RM2.20 RM2.00 RM2.45 Sell below RM2.30 on possible top at RM2.35<br />

IJM Corp IJM RM5.45 RM5.60 RM5.00 Buy above RM5.20 on possible bottom at RM5.0<br />

IJM Land IJMLAND RM2.40 RM2.50 RM2.10 Buy on close above 5-month resistance of RM2.20<br />

Inch Kenneth Rubber INCKEN RM1.00 RM1.10 RM0.90 Buy above RM0.92 on possible bottom at RM0.90<br />

Industronics ITRONIC RM0.50 RM0.45 RM0.63 Sell below RM0.60 on possible top at RM0.625<br />

IOI Corp IOICORP RM4.50 RM4.35 RM5.00 Sell below RM5.00 on possible top at RM5.05<br />

Ivory Properties Gp IVORY RM0.48 RM0.45 RM0.50 Sell below RM0.50 on possible top at RM0.52<br />

JCY International JCY RM0.58 RM0.54 RM0.65 Sell below RM0.625 on possible top at RM0.65<br />

JobStreet Corp JOBST RM2.80 RM3.00 RM2.40 Buy on rebound continuation above RM2.5<br />

Kamdar Group KAMDAR RM0.65 RM0.75 RM0.57 Buy on rally continuation above RM0.60<br />

KBB Resources KBB RM0.45 RM0.40 RM0.53 Sell below RM0.525 on possible top at RM0.50<br />

KKB Engineering KKB RM1.60 RM1.70 RM1.43 Buy on close above 3-month resistance of RM1.50<br />

KPJ Healthcare KPJ RM6.00 RM6.40 RM5.60 Buy above RM5.80 on possible bottom at RM5.60<br />

See important disclosure notice at the end of report<br />

Page 5 of 8

February and March’s Trading Stocks<br />

Stock<br />

OSK188<br />

Ticker<br />

1st<br />

Target<br />

2nd<br />

Target<br />

Cut-loss /<br />

Buyback<br />

Recommendation<br />

KSL Holdings KSL RM2.00 RM2.10 RM1.65 Buy on rally continuation above RM1.70<br />

Kump Hartanah Sgor KHSB RM0.70 RM0.80 RM0.62 Buy on rebound continuation above RM0.65<br />

Kump Perangsang KPS RM1.10 RM1.20 RM0.96 Buy above RM1.00 on possible bottom at RM0.96<br />

Kumpulan Europlus KEURO RM0.75 RM0.65 RM0.90 Sell on downtrend continuation below RM0.90<br />

Kumpulan Fima KFIMA RM1.60 RM1.45 RM1.87 Sell below RM1.80 on possible top at RM1.87<br />

Land & General L&G RM0.44 RM0.47 RM0.39 Buy on rebound continuation above RM0.40<br />

Lion Industries LIONIND RM1.00 RM1.05 RM0.90 Buy above RM0.93 on possible bottom at RM0.90<br />

London Biscuit LONBIS RM0.60 RM0.58 RM0.66 Sell on break of 12-month low of RM0.65<br />

MAA Group MAA RM0.55 RM0.60 RM0.48 Buy above RM0.50 on possible bottom at RM0.48<br />

Mah Sing Group MAHSING RM2.50 RM2.70 RM2.17 Buy on rebound continuation above RM2320<br />

Malayan Banking MAYBANK RM8.80 RM8.50 RM9.20 Sell below RM9.20 on possible top at RM9.20<br />

Malaysia Airlines MAS RM0.78 RM0.85 RM0.69 Buy above RM0.71 on possible bottom at RM0.69<br />

Malaysia Building Soc MBSB RM2.50 RM2.70 RM2.38 Buy on rebound continuation above RM2.40<br />

Malaysia Resources MRCB RM1.30 RM1.20 RM1.45 Sell below RM1.40 on possible top at RM1.45<br />

MBM Resources MBMR RM3.20 RM3.00 RM3.50 Sell below RM3.30 on possible top at RM3.50<br />

Media Prima MEDIA RM2.20 RM2.30 RM2.10 Buy above RM2.13 on possible bottom at RM2.10<br />

Microlink Solution MICROLN RM0.66 RM0.73 RM0.59 Buy on rally continuation above RM0.60<br />

Mudajaya Group MUDAJYA RM2.15 RM2.30 RM2.56 Sell on close below 12-month low of RM2.50<br />

MWE Holdings MWE RM1.90 RM2.00 RM1.65 Buy on rally continuation above RM1.80<br />

Naim Holdings NAIM RM2.20 RM2.35 RM1.90 Buy on close above 6-month resistance of RM2.00<br />

NTPM Holdings NTPM RM0.52 RM0.55 RM0.47 Buy on rebound continuation above RM0.475<br />

OCK Group OCK RM0.54 RM0.60 RM0.49 Buy above RM0.50 on possible bottom at RM0.48<br />

Pacific & Orient P&O RM1.50 RM1.65 RM1.30 Buy on rally continuation above RM1.40<br />

Padini Holdings PADINI RM1.70 RM1.60 RM1.90 Sell below RM1.90 on possible top at RM1.90<br />

Pantech Group PANTECH RM0.80 RM0.88 RM0.70 Buy above RM0.72 on possible bottom at RM0.695<br />

Pavilion REIT PAVREIT RM1.58 RM1.65 RM1.40 Buy on rally continuation above RM1.45<br />

Perak Corp PRKCORP RM1.60 RM1.75 RM1.35 Buy on close above 9-month resistance of RM1.40<br />

Perdana Petroleum PERDANA RM1.45 RM1.55 RM1.23 Buy on rally continuation above RM1.30<br />

Perisai Petroleum PERISAI RM1.15 RM1.22 RM0.96 Buy above RM1.00 on possible bottom at RM0.96<br />

Pestech International PESTECH RM1.23 RM1.30 RM1.07 Buy on rally continuation above RM1.10<br />

Petronas Chemicals PCHEM RM6.10 RM5.90 RM6.40 Sell below RM6.34 on possible top at RM6.40<br />

Poh Kong Holdings POHKONG RM0.40 RM0.36 RM0.48 Sell on break of 12-month low of RM0.44<br />

Pos Malaysia POS RM3.80 RM4.10 RM3.40 Buy above RM3.50 on possible bottom at RM3.40<br />

Power Root PWROOT RM1.22 RM1.12 RM1.50 Sell below RM1.45 on possible top at RM1.50<br />

PPB Group PPB RM13.20 RM14.00 RM12.00 Buy above RM12.30 on possible bottom at RM12.00<br />

Public Bank PBBANK RM16.00 RM16.40 RM15.30 Buy above RM15.70 on possible bottom at RM15.30<br />

Puncak Niaga Hldg PUNCAK RM1.50 RM1.60 RM1.34 Buy on rebound continuation above RM1.40<br />

QL Resources QL RM2.85 RM2.80 RM3.02 Sell on break of 12-month low of RM3.00<br />

Redtone International REDTONE RM0.45 RM0.50 RM0.37 Buy above RM0.38 on possible bottom at RM0.37<br />

SapuraKencana Pet SKPETRO RM2.75 RM2.60 RM2.95 Sell below RM2.85 on possible top at RM2.95<br />

Scomi Group SCOMI RM0.28 RM0.25 RM0.33 Sell on break of 5-month low of RM0.30<br />

Scomi Marine SCOMIMR RM0.45 RM0.50 RM0.38 Buy on rebound continuation above RM0.405<br />

SEG International SEG RM1.55 RM1.40 RM1.75 Sell on break of 12-month low of RM1.70<br />

Starhill REIT STAREIT RM1.20 RM1.30 RM1.07 Buy on rally continuation above RM1.12<br />

Sunway SUNWAY RM2.60 RM2.70 RM2.38 Buy on rebound continuation above RM2.45<br />

Syarikat Takaful TAKAFUL RM6.00 RM6.60 RM5.30 Buy above RM5.50. on possible bottom at RM5.30<br />

Ta Ann Holdings TAANN RM3.25 RM3.00 RM3.65 Sell below RM3.50 on possible top at RM3.65<br />

Tambun Indah TAMBUN RM0.87 RM0.95 RM0.79 Buy above RM0.81 on possible bottom at RM0.79<br />

Tan Chong Motor TCHONG RM5.50 RM6.00 RM4.90 Buy on rally continuation above RM5.00<br />

Top Glove Corp TOPGLOV RM5.80 RM6.10 RM5.40 Buy above RM5.50 on possible bottom at RM5.40<br />

Tradewinds Plant TWSPLNT RM5.00 RM5.30 RM4.30 Buy on rebound continuation above RM4.40<br />

Uchi Technologies UCHITEC RM1.30 RM1.40 RM1.14 Buy on break of 5-month resistance of RM1.20<br />

UEM Land Holdings UEMLAND RM2.50 RM2.60 RM2.20 Buy on rebound continuation above RM2.30<br />

UMW Holdings UMW RM13.00 RM13.90 RM11.90 Buy above RM12.20 on possible bottom at RM11.90<br />

Unisem UNISEM RM0.92 RM0.97 RM0.85 Buy above RM0.86 on possible bottom at RM0.845<br />

UOA Development UOADEV RM2.00 RM2.25 RM1.83 Buy on rebound continuation above RM1.9<br />

Uzma UZMA RM1.80 RM2.00 RM1.60 Buy above RM1.65 on possible bottom at RM1.60<br />

WCT WCT RM2.10 RM2.00 RM2.25 Sell below RM2.20 on possible top at RM2.25<br />

Willoglen MSC WILLOW RM0.40 RM0.42 RM0.35 Buy on rally continuation above RM0.36<br />

Xingquan Intl XINQUAN RM0.90 RM1.00 RM0.77 Buy on break of 5-month resistance of RM0.80<br />

Yinson Holdings YINSON RM2.50 RM2.70 RM2.23 Buy on rally continuation above RM2.35<br />

YTL Corp YTL RM1.70 RM1.80 RM1.55 Buy above RM1.60 on possible bottom at RM1.55<br />

YTL Power Intl YTLPOWR RM1.45 RM1.35 RM1.52 Sell on downtrend continuation below RM1.50<br />

See important disclosure notice at the end of report<br />

Page 6 of 8

<strong>RHB</strong> Guide to Investment Ratings<br />

Buy: Share price may exceed 10% over the next 12 months<br />

Trading Buy:Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain<br />

Neutral:Share price may fall within the range of +/- 10% over the next 12 months<br />

Take Profit:Target price has been attained. Look to accumulate at lower levels<br />

Sell:Share price may fall by more than 10% over the next 12 months<br />

Not Rated:Stock is not within regular research coverage<br />

Disclosure & Disclaimer<br />

All research is based on material compiled from data considered to be reliable at the time of writing, but <strong>RHB</strong> does not make any representation or warranty,<br />

express or implied, as to its accuracy, completeness or correctness. No part of this report is to be construed as an offer or solicitation of an offer to transact any<br />

securities or financial instruments whether referred to herein or otherwise. This report is general in nature and has been prepared for information purposes only. It<br />

is intended for circulation to the clients of <strong>RHB</strong> and its related companies. Any recommendation contained in this report does not have regard to the specific<br />

investment objectives, financial situation and the particular needs of any specific addressee. This report is for the information of addressees only and is not to be<br />

taken in substitution for the exercise of judgment by addressees, who should obtain separate legal or financial advice to independently evaluate the particular<br />

investments and strategies.<br />

<strong>RHB</strong>, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in securities of the<br />

company(ies) covered in this research report or any securities related thereto, and may from time to time add to, or dispose off, or may be materially interested in<br />

any such securities. Further, <strong>RHB</strong>, its affiliates and related companies do and seek to do business with the company(ies) covered in this research report and may<br />

from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them or buy them from<br />

customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or underwriting services for or relating to such<br />

company(ies), as well as solicit such investment, advisory or other services from any entity mentioned in this research report.<br />

<strong>RHB</strong> and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise from<br />

any reliance based on this report or further communication given in relation to this report.<br />

The term “<strong>RHB</strong>” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned specifically herein below and<br />

shall refer to <strong>RHB</strong> Research Institute SdnBhd, its holding company, affiliates, subsidiaries and related companies.<br />

All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for any purpose without prior<br />

consent of <strong>RHB</strong> and <strong>RHB</strong> accepts no liability whatsoever for the actions of third parties in this respect.<br />

Malaysia<br />

This report is published and distributed in Malaysia by <strong>RHB</strong> Research Institute SdnBhd (233327-M), Level 11, Tower One, <strong>RHB</strong> Centre, JalanTunRazak, 50400<br />

Kuala Lumpur, a wholly-owned subsidiary of <strong>RHB</strong> Investment Bank Berhad (<strong>RHB</strong>IB), which in turn is a wholly-owned subsidiary of <strong>RHB</strong> Capital Berhad.<br />

As of 12 March 2013, <strong>RHB</strong>IB does not have proprietary positions in the subject companies, except for:<br />

a) -<br />

As of 12 March 2013, none of the analysts who covered the stock in this report has an interest in the subject companies covered in this report, except for:<br />

a) -<br />

Singapore<br />

This report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned subsidiary of DMG &<br />

Partners Securities Pte Ltd, a joint venture between OSK Investment Bank Berhad, Malaysia (“OSKIB”) and Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary<br />

of Deutsche Bank Group). DMG & Partners Securities Pte Ltd is a Member of the Singapore Exchange Securities Trading Limited and is a subsidiary of OSKIB,<br />

which in turn is a wholly-owned subsidiary of <strong>RHB</strong> Capital Berhad.DMG& Partners Securities Pte Ltd may have received compensation from the company<br />

covered in this report for its corporate finance or its dealing activities; this report is therefore classified as a non-independent report.<br />

As of 12 March 2013, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have proprietary positions in<br />

the subject companies, except for:<br />

a) -<br />

As of 12 March 2013, none of the analysts who covered the stock in this report has an interest in the subject companies covered in this report, except for:<br />

a) -<br />

See important disclosure notice at the end of report<br />

Page 7 of 8

Special Distribution by <strong>RHB</strong><br />

Where the research report is produced by an <strong>RHB</strong> entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore, it is only distributed to<br />

"Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an<br />

"Institutional Investor", "Expert Investor" or "Accredited Investor", this research report is not intended for you and you should disregard this research report in its<br />

entirety. In respect of any matters arising from, or in connection with this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte<br />

Ltd.<br />

Hong Kong<br />

This report is published and distributed in Hong Kong by OSK Securities Hong Kong Limited (“OSKSHK”), a subsidiary of OSK Investment Bank Berhad,<br />

Malaysia (“OSKIB”), which in turn is a wholly-owned subsidiary of <strong>RHB</strong> Capital Berhad.<br />

OSKSHK, OSKIB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the subject company. OSKSHK,<br />

OSKIB and/or other affiliates may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain compensation for<br />

investment banking services from the subject company.<br />

Risk Disclosure Statements<br />

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will<br />

be incurred rather than profit made as a result of buying and selling securities. Past performance is not a guide to future performance. OSKSHK does not maintain<br />

a predetermined schedule for publication of research and will not necessarily update this report<br />

Indonesia<br />

This report is published and distributed in Indonesia by PT OSK Nusadana Securities Indonesia, a subsidiary of OSK Investment Bank Berhad, Malaysia, which in<br />

turn is a wholly-owned subsidiary of <strong>RHB</strong> Capital Berhad.<br />

Thailand<br />

This report is published and distributed in Thailand by OSK Securities (Thailand) PCL, a subsidiary of OSK Investment Bank Berhad, Malaysia, which in turn is a<br />

wholly-owned subsidiary of <strong>RHB</strong> Capital Berhad.<br />

Other Jurisdictions<br />

In any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance with the law and regulations of<br />

the jurisdictions.<br />

Kuala Lumpur Hong Kong Singapore<br />

Malaysia Research Office<br />

<strong>RHB</strong> Research Institute SdnBhd<br />

Level 11, Tower One, <strong>RHB</strong> Centre<br />

Jalan Tun Razak<br />

Kuala Lumpur<br />

Malaysia<br />

Tel : +(60) 3 9280 2185<br />

Fax : +(60) 3 9284 8693<br />

See important disclosure notice at the end of report<br />

OSK Securities<br />

Hong Kong Ltd.<br />

12 th Floor<br />

World-Wide House<br />

19 Des Voeux Road<br />

Central, Hong Kong<br />

Tel : +(852) 2525 1118<br />

Fax : +(852) 2810 0908<br />

DMG & Partners<br />

Securities Pte. Ltd.<br />

10 Collyer Quay<br />

#09-08 Ocean Financial Centre<br />

Singapore 049315<br />

Tel : +(65) 6533 1818<br />

Fax : +(65) 6532 6211<br />

Jakarta Shanghai Phnom Penh<br />

PT OSK Nusadana<br />

Securities Indonesia<br />

Plaza CIMB Niaga<br />

14th Floor<br />

Jl. Jend. Sudirman Kav.25<br />

JakartaSelatan12920, Indonesia<br />

Tel : +(6221) 2598 6888<br />

Fax : +(6221) 2598 6777<br />

OSK (China) Investment<br />

Advisory Co. Ltd.<br />

Suite 4005, CITIC Square<br />

1168 Nanjing West Road<br />

Shanghai 20041<br />

China<br />

Tel : +(8621) 6288 9611<br />

Fax : +(8621) 6288 9633<br />

Bangkok<br />

OSK Securities (Thailand) PCL<br />

10th Floor,SathornSquareOfficeTower<br />

98, North SathornRoad,Silom<br />

Bangrak, Bangkok 10500<br />

Thailand<br />

Tel: +(662) 862 9999<br />

Fax : +(662) 108 0999<br />

OSK Indochina Securities Limited<br />

No. 1-3, Street 271<br />

Sangkat Toeuk Thla, Khan Sen Sok<br />

Phnom Penh<br />

Cambodia<br />

Tel: +(855) 23 969 161<br />

Fax: +(855) 23 969 171<br />

Page 8 of 8