Updated April 11, 2022, to add more context to competing provider complaints about the IRS' handling of its list of 2290 e-file providers.

Around this time of year, a common question asked by truckers calling one of the many companies offering e-filing of Form 2290 Heavy Highway Vehicle Use Tax is: “Are you guys the company I used last year?”

Search “2290 tax filing” on Google and you’ll see why owner-operators might need that memory jog. There are 52 Internal Revenue Service-approved “modernized e-file” providers nationwide listed there. Some are well-known names in trucking, like Comdata, J.J. Keller & Associates and Express Truck Tax.

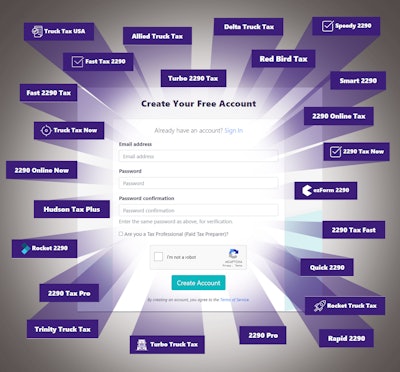

That count, though, appears to be misleading. Nearly half are little more than web pages with differing URLs and slightly different designs that all send filers to what appears to be a shared backend. User registration on one such site – AlliedTruckTax.com, for instance – enables easy login at any of the others, such as Red Bird Tax, TurboTruckTax.com, Rocket Truck Tax, Rocket2290.com and others that have separate links on the IRS approved-provider page.

Some of the other providers, using only one listing, are upset that some of the apparently related sites use names similar to those of established companies. They’re also unhappy that when customers choose an e-file provider at random, the multiplicity of listings creates an unfair advantage for what’s believed to be a single owner.

Generally, prices for e-filing range among providers from as low as $10 to much higher, depending on the size of the fleet. At the apparently related sites, fleets of up to 24 vehicles can file for $65.95. The HVUT fee itself is $550 for most Class 8 combination units and is due by Aug. 31 each year.

The 24 related sites list no phone number on their contact pages. Overdrive queries sent to the email contact address listed for Allied Truck Tax and Rocket 2290 received no direct response.

Vincent Carney, reached through a phone number listed elsewhere for Allied Truck Tax, said he’d received the emails but his attorney has advised him not to comment. Carney is the registered agent on state of Missouri incorporation papers for Union Group Labs, LLC, which is in the middle of lawsuits with a competing 2290 e-filing service.

The U.S. Federal Trade Commission, which investigates questionable online marketing practices, did not respond to Overdrive‘s inquiries.

The IRS is well “aware of the situation” and “looking into it,” but cannot comment further, spokesman James E. Southwell said in response to an Overdrive query.

(A year after this story's 2020 publication, the same IRS spokesman, queried about these IRS list again, noted that all affiliated companies had individual employer identification numbers and had all met "suitability and testing requirements to become an Authorized e-File Provider" in accordance with guidelines set forth in the agency's Publication 3112. Read more about the subsequent year's list via this link.)

The IRS, however, did respond to the group of longtime e-file providers who complained. The agency said each of the sites in question passed the IRS’s approval process and, to an extent, the agency’s hands are tied.

Phil Boyer, of the long-in-business Instant 2290 (i2290.com) service, says the list has at least been modified at times by the IRS in response to provider complaints about companies using multiple listings. In 2014, for instance, Boyer said, the IRS removed some duplicate listings.

“The IRS originally created this page to be a useful resource for truck owners to find e-file providers,” said Boyer. “By allowing one provider half of all listings, the IRS greatly reduces the utility of their page. It’s nearly useless in its current state.”

With some minor variations, login at each of the 24 websites appears to flow much like it does in this illustration, which shows the company names and websites at issue.

With some minor variations, login at each of the 24 websites appears to flow much like it does in this illustration, which shows the company names and websites at issue.The requirements for e-file providers detailed in IRS Publication 3112 include adherence to certain advertising standards and a clear display of a provider’s “doing business as” name at all locations and websites where a provider obtains taxpayer information. The current provider with multiple listings could be violating the latter requirement, given a single, shared backend system presents itself as 24 separate companies, said Agie Sundaram, CEO of SPAN Enterprises, which owns Express Truck Tax service.

Sundaram and other providers have been making their concerns known to the IRS since early this year. “There’s been no fruit from that,” says Charles Hardy, SPAN’s director of administration.

Since initial complaints to the agency early in the year, SPAN attempted what’s known as a “DMCA takedown” notice for copyright infringement. The process is made possible by the Digital Millennium Copyright Act. SPAN directed the action against one of the sites whose name SPAN believes mimicked its own “Express Truck Tax” business. That suspect URL, Express2290tax.com, now redirects to Rocket2290.com, another site operating in the same manner and on the IRS’s approved e-file provider list.

SPAN Enterprises was subsequently sued in Florida’s middle federal district for alleged unfair copyright-law use. The company is now caught up in a series of counterclaims of its own with Union Group Labs and Carney.

Among contentions made in its counterclaims, Sundaram said, SPAN alleges the sites misrepresent themselves to the IRS in some instances by using business addresses that correlate with the physical locations of U.S. Postal Service facilities, without the identification of a corresponding P.O. box.

All of the sites’ domain names, too, are privately registered, meaning the site owner is not publicly available for lookup. This, SPAN believed, also fails to abide by an IRS requirement that all domain names where any 2290 provider hosts a website must not be private. Yet that requirement appears in IRS Publication 1345, and explicitly is for e-file providers of individual income tax returns, not 2290 e-file providers.

IRS Publication 3112 stipulates that a provider can be denied approval for “disreputable conduct or other facts that may adversely impact IRS e-file.” That’s the case here, Boyer believed, yet the IRS clearly feels the provider has met the agency's requirements as written.

“A trusted government resource showing partiality,” Boyer believed, particularly in a case “as egregious as this, wreaks havoc on the benefits of a free market. It doubles down in opposition. One business, presented 24 times more than every other, and by a ‘trusted’ public agency.”

For truckers evaluating e-file providers, Boyer recommended vetting any provider with a phone call or email to ensure the existence of some level of customer service response before taking a risk on one or another.

Sundaram recommended the same, as well as a close looks at a provider’s “About Us” or other information page. “Do they have actual pictures of their employees?” he said. Is their mailing address more than just a post office location or “a WeWork/shared office? … It’s your personal and confidential information you are putting on their website — just make sure.”

Better yet, Boyer added, look for a referral from someone you trust. “I’d suggest people talk to someone they know who files electronically. That’s a lot safer than relying on that [IRS] list” as it stands today, he said.