Using Dave Ramsey’s EveryDollar Budgeting App To Plan a Family Budget

When my wife and I were a newly married young couple, we were pretty disciplined at budgeting our money. We had to be, because we didn’t have much of it. As we moved on in our career, and our businesses have done well for us, we moved away from being disciplined budgeting and replaced a monthly budget with a general “be frugal wherever possible” attitude.

Fast forward to now. My wife and I have six children, and our seventh is on the way. Although we are still doing well financially and have saved quite a bit of money, I recently had one of those stressful moments where I took a look at our bank accounts and realized that we haven’t been saving as much as we should over the past six months despite having an income of well over $100,000 per year. I had a little chat with my wife, and we decided to get back into a formal budget.

In the distant past, we relied upon spreadsheets along with credit card and bank statements to put together a budget. But in our more recent efforts to be disciplined at budgeting, we’ve found it much more efficient to use the EveryDollar budgeting app made by Dave Ramsey’s organization Ramsey Solutions. EveryDollar can be used on a Mac, a PC, and is available to install as an app on an iPhone or on an Android. The fact that the software is available on each of those technology choices makes it easier to use by the entire family.

I’ll explain how and why we use the EveryDollar tools to set up and maintain our family budget.

Financial Peace Through a New Habit of Disciplined Budgeting

Dave Ramsey’s flagship product is a program called Financial Peace University (FPU), and it’s appropriately named. The program – which includes lessons about financial management, as well as access to a network of professionals, a community of others working their ways to financial peace, and tools for organizing your efforts – helps people who struggle with money (and those who aren’t so bad) learn how to be master budgeters, to save money for emergencies and retirement, and to pay of debt to the extent that exists for individuals and couples.

The EveryDollar budgeting app is a natural extension of and a tool included with Ramsey’s Financial Peace University, but you don’t have to take the course to use EveryDollar effectively. If you tend to struggle with discipline and forming new positive habits, you might consider joining the FPU program to reinforce your increase your chances of succeeding.

The first thing you need to successfully use EveryDollar is simply a commitment to gaining control over your finances. Research has shown that it takes just over 60 days to establish a habit, so if you can dedicate yourself for the next two months to setting up and using EveryDollar, you’re on your way.

Committing to a Budget

The main advantage of budgeting is that it aligns your spending with your life’s mission, your goals, and what you want to ultimately become. The alternative is to bounce along spending money in a way that is not connected to what you really want of of life. When your spending is not intentional and purposeful, you tend to waste a lot and impulse buy, which causes stress and a very real feeling of lacking control over your natural self.

One of the precursors to a budget that I’ve experienced (while taking a dating and courtship class in college) is simply recording every expense you have for a month, then reviewing and categorizing those expenses once the month is over. The first time I did it was a real eye opener. I was surprised at how the totals came out for the various categories I used. I was able to make some significant changes to my spending habits (even though I didn’t have much to spend, which made it more important to use every dollar wisely) and get through my two years of junior college without any debt.

If you can commit to using a budget over the next two months and setting aside time for monthly, weekly, and daily financial planning, tracking each expense against a planned budget, you’re likely ready to jump into using EveryDollar.

Why Use Budgeting Software

Some people are afraid of having to learn new software to change habits and increase their overall productivity, but there are several reasons to go the digital route. First, it’s a more efficient way to keep up with recording information that could be tedious otherwise. Second, all of the manual stuff, doing calculations like deducting any particular expense from the budget you have left for the month, is done behind the scene, automatically, allowing you to better focus on developing your budgeting skills without being overwhelmed.

Budgeting software like EveryDollar doesn’t have so many bells and whistles that you feel like you need to take a class to be able to use its functionality. Instead, you simply enter in your expected income, and what expenses you anticipate over the next month. With most personal finance budgeting applications, you can group and categorize your expenses, and you can see an overview report at the end of the month that shows you how you did compared to your plan.

If you are averse to technology, it certainly doesn’t disqualify you from budgeting and setting financial goals. Using the old school paper and pen method works better for some people, especially the older generation. But even for that group, I’d say don’t be afraid. Give it a shot, and you might be surprised at how accessible it is, even for people who are less familiar with computers, smart phones, and apps.

Advantages of EveryDollar Over Other Budgeting Software

There are lots of different budgeting software programs a person could choose to use and be successful with budgeting. Some alternatives to EveryDollar include HomeBank, Mint.com, and You Need a Budget (YNAB), each of which or reasonably priced (YNAB is $6.99/month) and each of which has all the features you need to start and maintain a budget.

However, there are some significant reasons why we choose to use EveryDollar.

Last year my wife and I were part of a self-reliance group at our church that was focused on personal finance and budgeting. After the first class, all twelve of the participants in the class were asked to choose a budgeting system to use throughout our 12-week program. When we reconvened the next Sunday, all of us had chosen EveryDollar. Here are some reasons why.

EveryDollar is very simple to use, and was built to naturally fit the guidelines provided in Dave Ramsey’s 7 Baby Steps program and the advice he gives in his Financial Peace University course. There are links built in to the software resources that can help with budgeting, including Baby Steps, FPU, and finding Ramsey-endorsed local providers (ELPs) for helping with major financial decisions like insurance, tax services, real estate, and retirement and investing. When you use EveryDollar, you feel like you’re part of the wider Ramsey community.

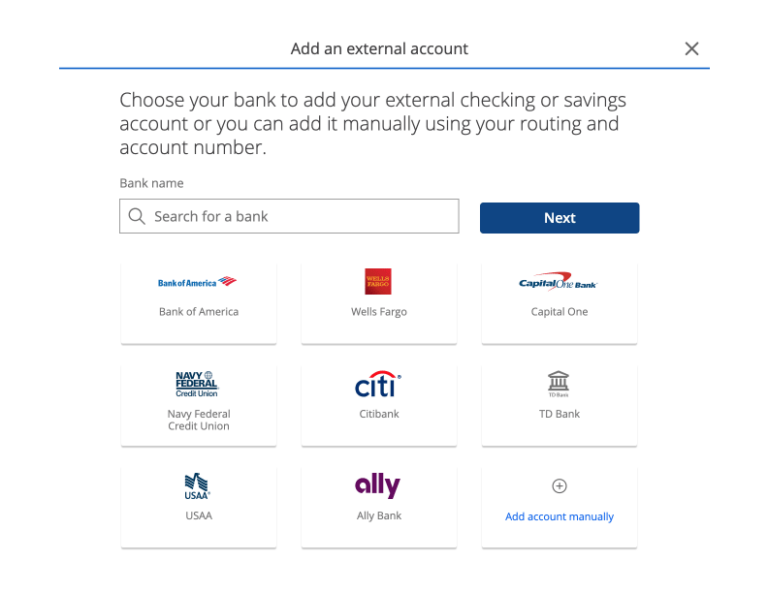

There is a free version of EveryDollar available that has everything you need for creating your budget. You can also choose to pay $99 per year ($8.25 per month) to connect your bank and other accounts so that transactions are entered automatically, saving you time and reducing chances of input error.

EveryDollar can be used seamlessly on a Mac or Windows computer as well as on Apple iOS and Android devices. This means you can easily sit down with your spouse and/or kids and plan and review your budget at home, then have everyone who will be spending money and tracking expenses simply update the budget after each transaction using a mobile device. The benefits of having laptops and phones working on the same account are tremendous, because remembering to enter expenses (or even income updates) later can put you behind and discourage you from keeping up on your budget.

How to Get Started Using EveryDollar

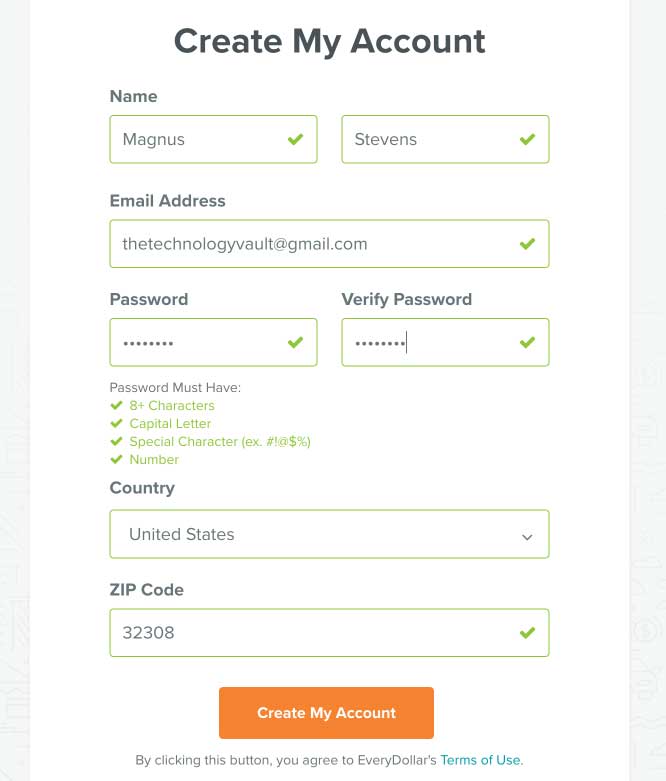

To get started using EveryDollar, you can set up an account on EveryDollar.com using just your name, an email address, a password, and a zip code. Once you’ve created your account and verified your email address, I recommend going ahead and installing the EveryDollar app from Google Play or the AppStore, depending upon which kinds of devices are used by those who will be participating in your family budget. You can also install the apps later, after you’ve set up your budget. Either way, the app data synchronizes with whatever you enter in from your laptop or desktop computer. So you can skip the app install step and do that later if you prefer to set up your budget first using your computer.

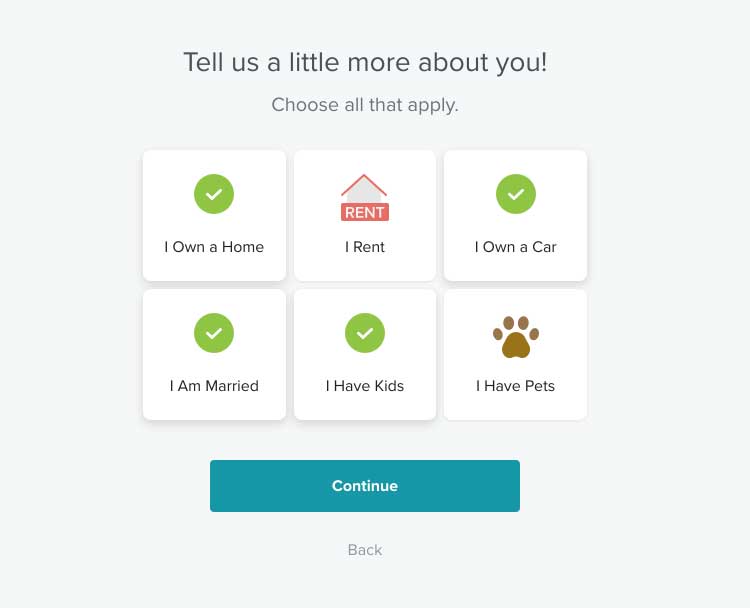

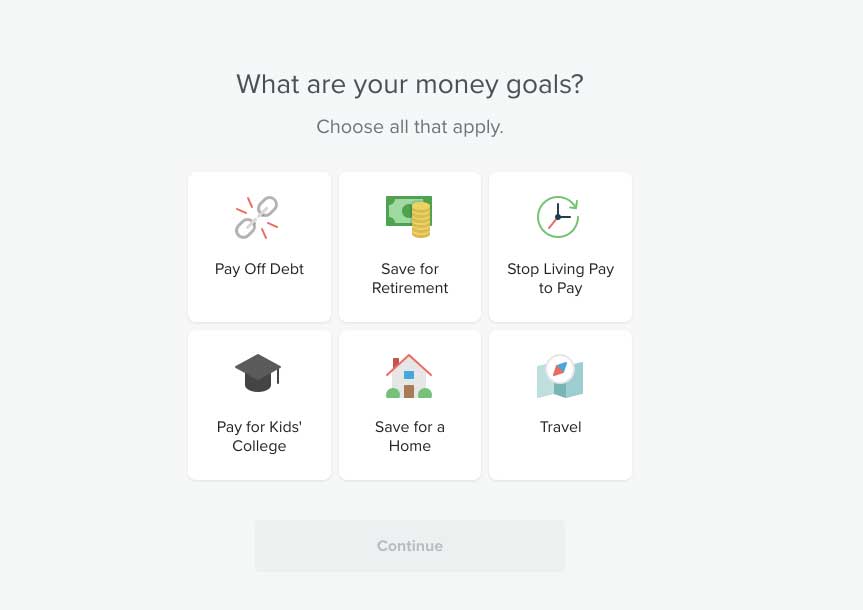

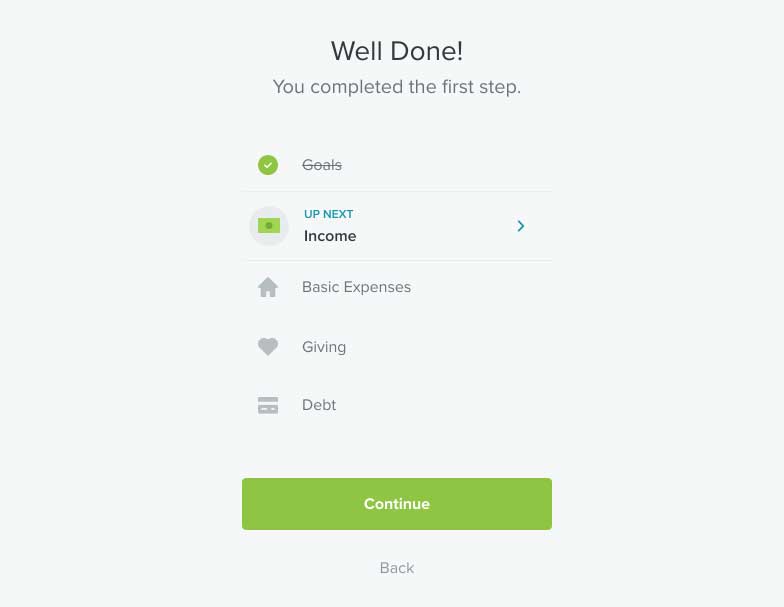

To set up your budget, EveryDollar walks you through a guide that is slightly customized based upon your goals, which you’re asked about on the first screen. Suggested goals include paying off debt, saving for retirement, getting out of the paycheck to paycheck habit, paying for kids’ college, saving to buy a home, or doing more travel. EveryDollar also asks you about your personal circumstances so that a little customization can be done according to whether you own a home or rent, own a car, are married and/or have kids, or own a pet.

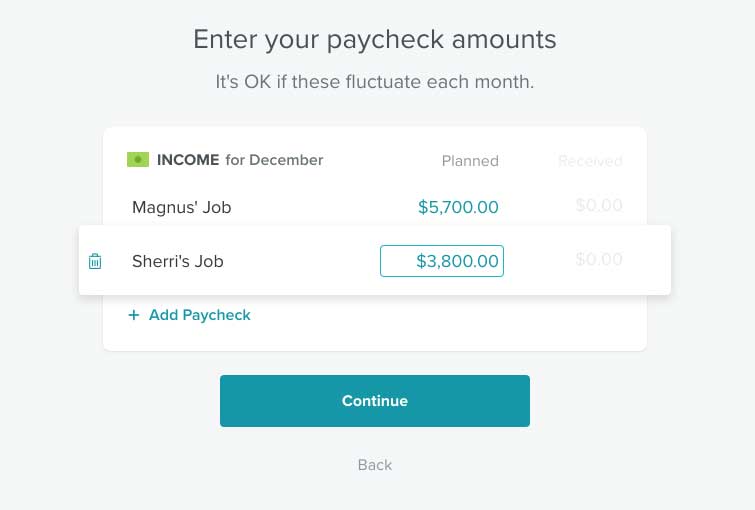

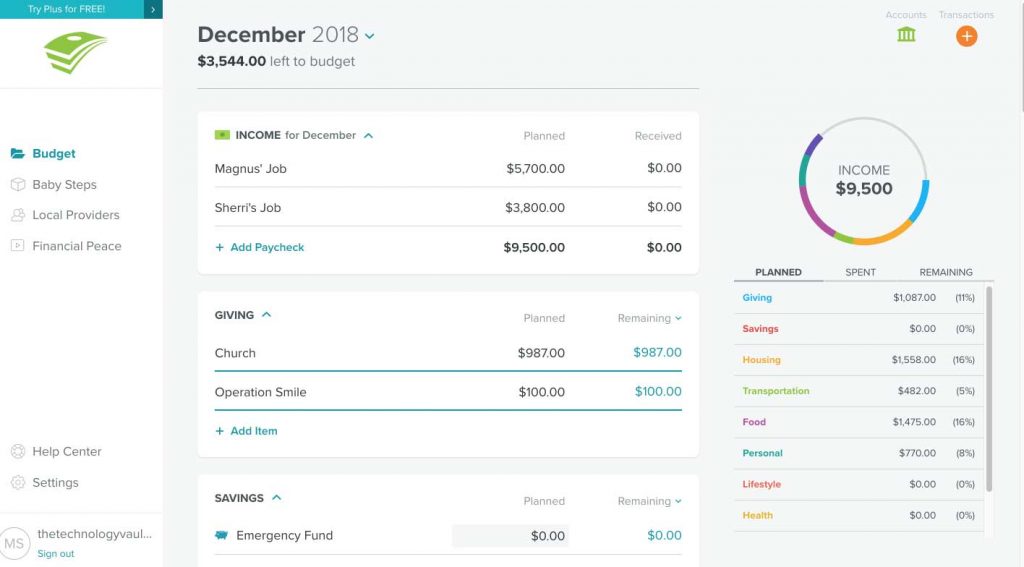

Following the questions about your goals and your particular circumstances, EveryDollar then walks you through the process of adding your expected monthly income, which can be listed as more than one income line.

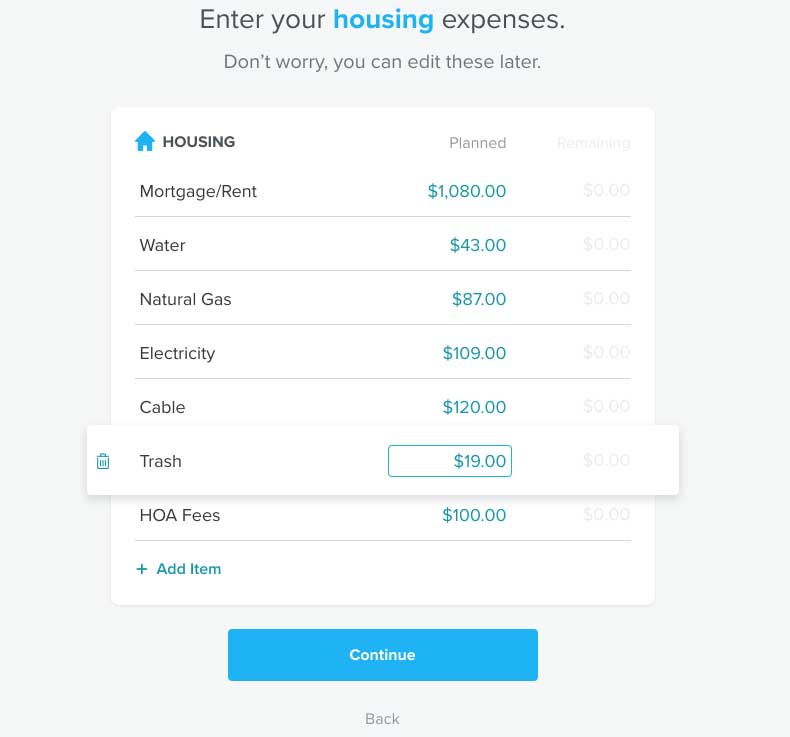

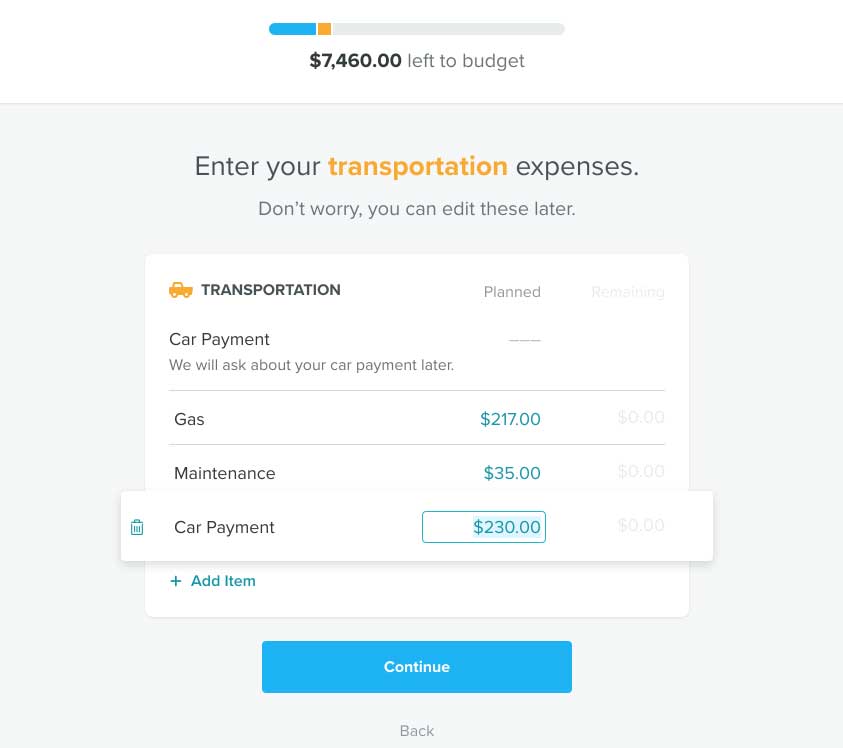

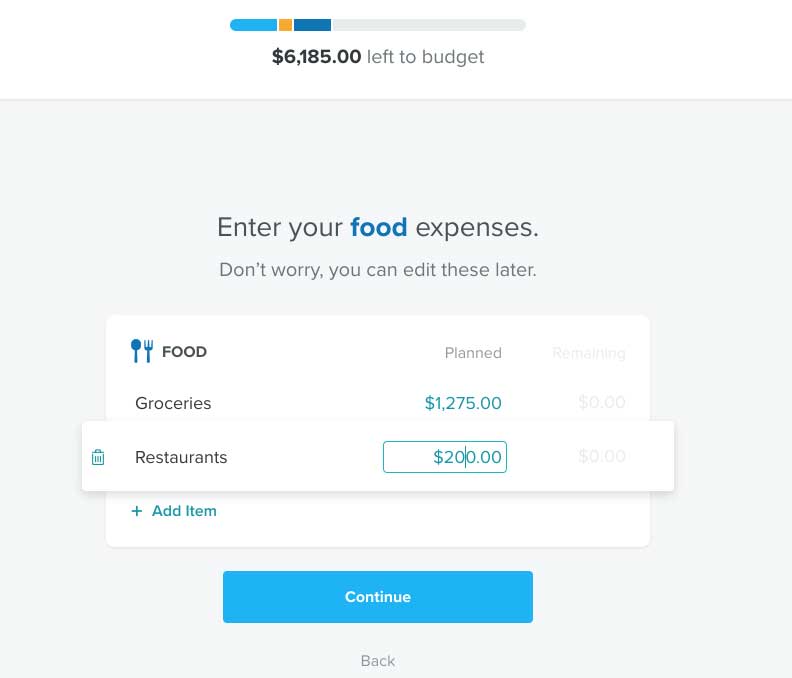

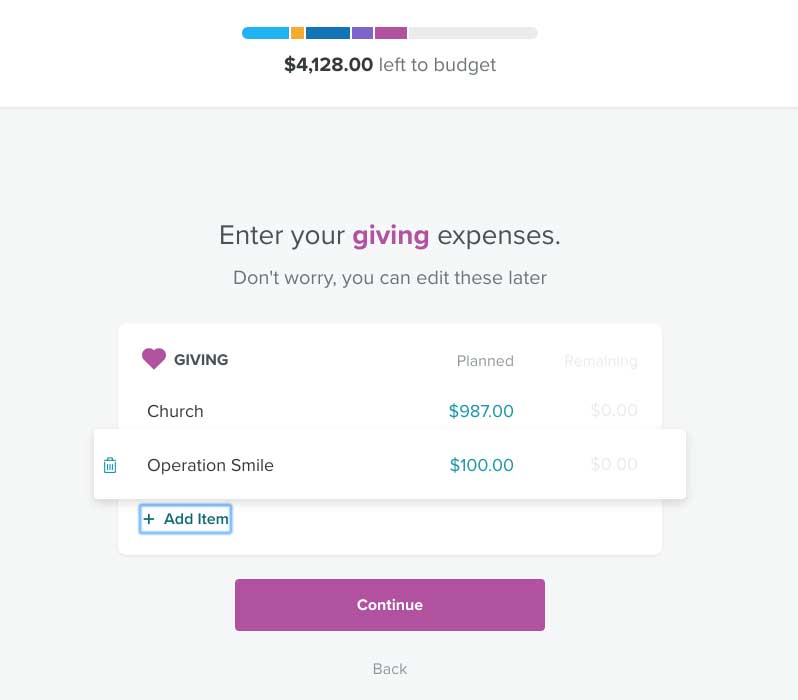

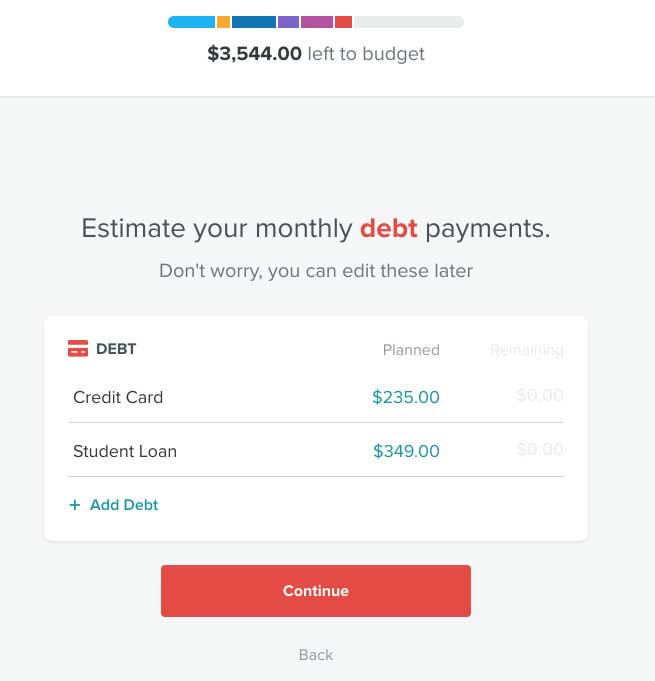

After you’re finished entering all sources and amounts for your household income, you are then able to input expenses related to the most common classifications found in most households, including: housing, transportation, food, giving, and debt. You can add other categories as well. For our home, we have expenses for travel, music lessons and other forms of education that we consume.

Once you finish the EveryDollar startup guide, having entered your basic income and expenses, you end up on the EveryDollar dashboard, which shows you at a glance how much you have left to budget beyond what’s been accounted for so far. You can add new categories that include spending on investment, whatever insurance needs you feel best for your family, and any of the other hundreds of worthy purposes you might have for allocating your monthly income.

Maintaining Your Budget

Getting your budget set up is an awesome first start, but there is still a ways to go before your budgeting habits become locked in, making you become that person you want to be, who uses much more intention about financial decisions.

The first habit I recommend is entering expenses into your budget as soon as they hit your bank account or credit or debit card, or when they’re paid for using cash. There are many expenses that you can anticipate beforehand. In my household, we know when payment is due for our music lessons, and we know how much that amount will be, so we go ahead and enter that into the expense sheet for the entire month at the beginning of the month.

The next habit I recommend is sitting down with your spouse on a weekly basis (we meet on Sunday nights) and reviewing your expenditures as well as your income. During this meeting, you can assess whether your spending that week was in alignment with your family mission and goals, and you can make whatever adjustments you feel are necessary.

Third, I recommend a monthly review of your budget. My wife and I use the same meeting time as our weekly budget review meeting, but we extend it some to allow us more time to take a bird’s eye view of our finances.

Often during this discussion, my wife and I consider whether there is not something else we might need to be doing to increase our income. We are self-employed, and there are lots of ways we can boost any of the several internet businesses we operate.

If you’re not self-employed, there are still ways that you can increase your income, including through a part-time job. I’ve written about how you can do things like write content articles from home on a very flexible schedule to bring more income into your family budget. Often this extra income is necessary as you add more children to your family.

Creating and Tracking a Budget With EveryDollar Will Improve Your Family’s Well-Being

I hope that this article has helped you see the merits of 1) disciplined budgeting and 2) using EveryDollar to simply and easily track your income and expenses in a way that makes your income and spending intentional, lining up with your core values.

If you have other suggestions that you feel I have missed, please share them with me here or through one of our Prosperopedia social media channels.