Reflecting on Boingo Wireless' (NASDAQ:WIFI) Share Price Returns Over The Last Three Years

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Boingo Wireless, Inc. (NASDAQ:WIFI) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 55% decline in the share price in that time. And over the last year the share price fell 22%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days.

View our latest analysis for Boingo Wireless

Boingo Wireless wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Boingo Wireless saw its revenue grow by 11% per year, compound. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 16% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

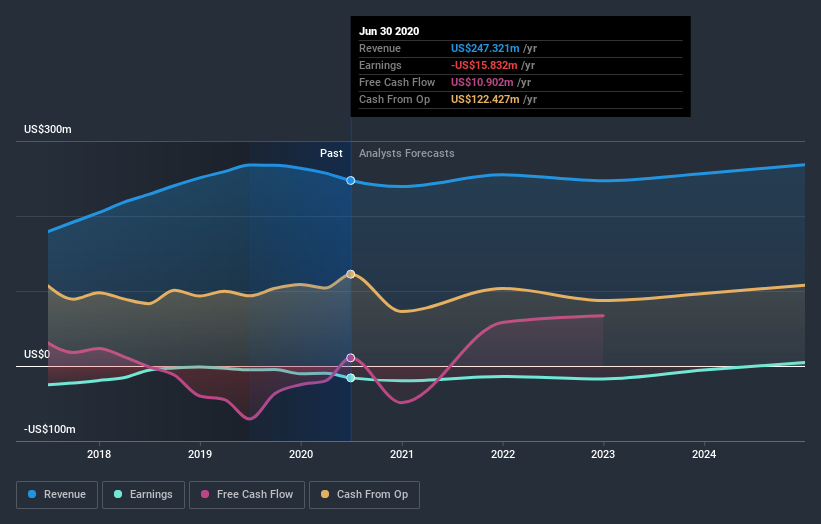

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Boingo Wireless had a tough year, with a total loss of 22%, against a market gain of about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Boingo Wireless better, we need to consider many other factors. Even so, be aware that Boingo Wireless is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.